Where Do They Sell Make America Great Again Hats

FEATURING DAYMOND JOHN

• STAR OF ABC'S SHARK TANK

• FOUNDER OF FUBU

My name isDaymondJohn.

I'm known as "The People's Shark."

TODAY, I'M LAUNCHING A BOLD MISSION.

I'M RECRUITING AMERICANS WHO WANT TO BE PART OF SOMETHING BIGGER THAN THEMSELVES.

Together, we'll join forces with our nation's greatest entrepreneurs…

To ignite an American comeback.

This comeback will spread from coast to coast – transforming every Main Street in every town.

This is personal to me.

In the early '90s, I started my company in my mom's basement with only $40.

America was caught in the crosshairs of a devasting economic recession.

Social unrest pushed neighborhoods to the breaking point.

I never gave up – because failure was never an option.

My startup grew into a thriving business – then a $6 billion empire, creating thousands of jobs.

I achieved the American Dream…

Now, it's time to pay it forward.

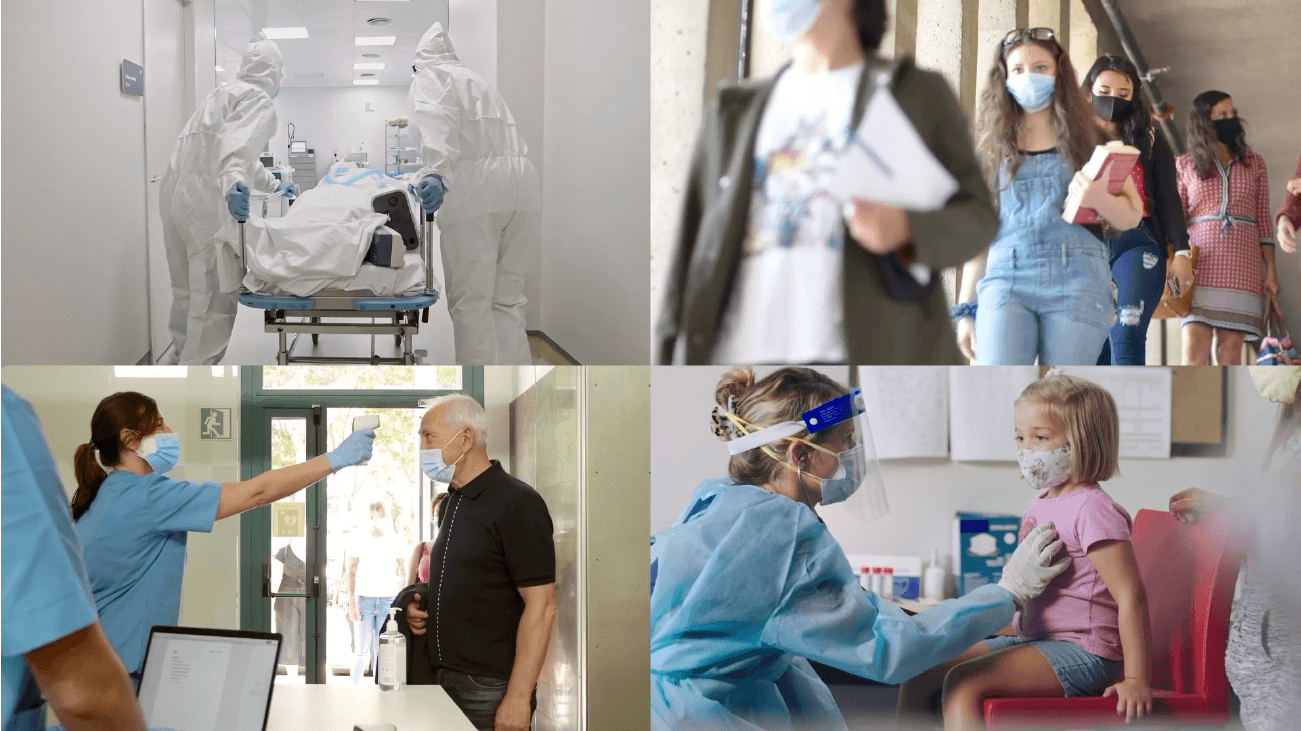

Last year, the pandemic crossed our borders and attacked our way of life.

Millions of our friends, family, and neighbors lost their jobs.

America became a nation of ghost towns as empty schools, airports, subways, and stores battered our economy.

WE WERE KNOCKED DOWN. BUT ONLY A FOOL WOULD'VE COUNTED US OUT.

JUST AS WE'VE DONE THROUGHOUT HISTORY, AMERICANS STOOD UP TO FACE OUR COMMON FOE.

Doctors and nurses rushed to the front lines…

Patriotic workers, to the assembly lines…

Today, our economy is recovering…

But there's still plenty of work to do.

As I look over the city, I see unlimited opportunity.

IT'S DURING OUR TOUGHEST TIMES WHEN HISTORY'S GREAT VISIONARIES BUILT THE BUSINESSES THAT CHANGED THE WORLD.

BUT THEY DIDN'T DO IT ON THEIR OWN.

THEY HAD AMERICANS JUST LIKE YOU AND ME – WITH THE GUTS TO BACK THEM – WHEN THEY WERE FIRST GETTING OFF THE GROUND.

The next Elon Musk, Steve Jobs, and Jeff Bezos is out there – working in some small office on a shoestring budget.

Building the nextTesla…

The nextApple…

The nextAmazon.

Let's help them.

If we succeed, the dreams of generational wealth could become a reality…

But just as important – those visionaries could create hundreds of thousands of jobs.

THIS IS AMERICA'S COMEBACK.

LET'S GET TO WORK.

I'm Daymond John, and I'm standing in a warehouse in Queens, New York – actually not far from where I launched the company that changed my life.

I've got three of my top senior analysts with me.

Joining us will be some of America's greatest entrepreneurs.

The cameras are here because the mission we're launching is enormous.

You need to hear about it directly from us.

COVID-19 was the worst sucker punch in modern history…

But now, America is on the rebound. We're coming back stronger than ever.

OUTSIDE ON THOSE STREETS – AND THE STREETS OF EVERY CITY AND TOWN – IS THE FUTURE…

THE NEXT GENERATION OF AMERICAN INNOVATORS.

WHEN OUR COUNTRY HAS CALLED, THEY'VE ALWAYS ANSWERED.

Take the Panic of 1907.

It unleashed a recession, a run on the banks, and a 50% stock market crash.

It struck while America was rebuilding San Francisco, which had been destroyed by the Great Earthquake.

William Durant was one of the innovators who led America's Comeback.

Durant was a high school dropout who had done pretty well for himself – building horse-drawn carriages.

In the midst of this chaos, he founded General Motors.

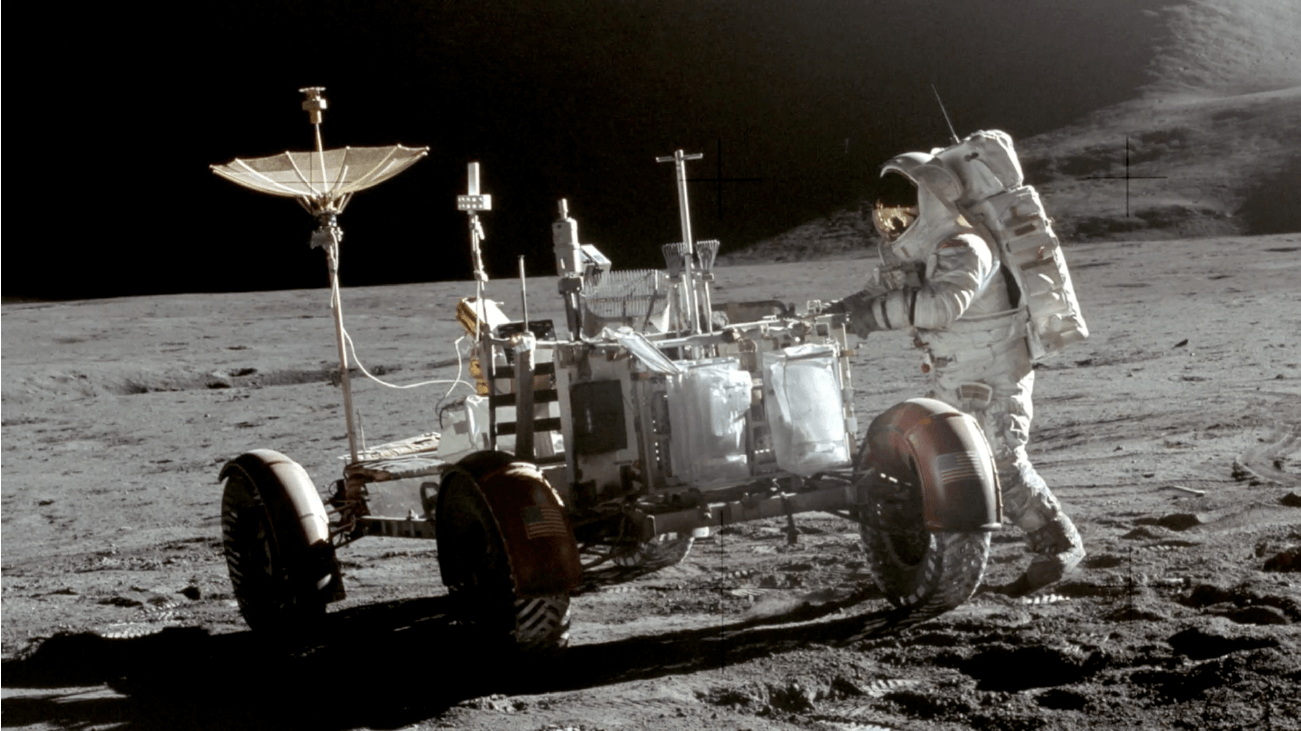

GM went on to create of some of America's most iconic cars and trucks…

As well as the Lunar Rover for the Apollo 15 mission.

Today,GM employs about191,000 people.

Charles Flint helped America come back from the Panic of 1910.

He founded the company we know as IBM.

Early on, they built time clocks and punch cards for businesses who wanted to put people back to work…

And today,IBMis using artificial intelligence to solve some of our greatest challenges…

While providing jobs for more than350,000 people.

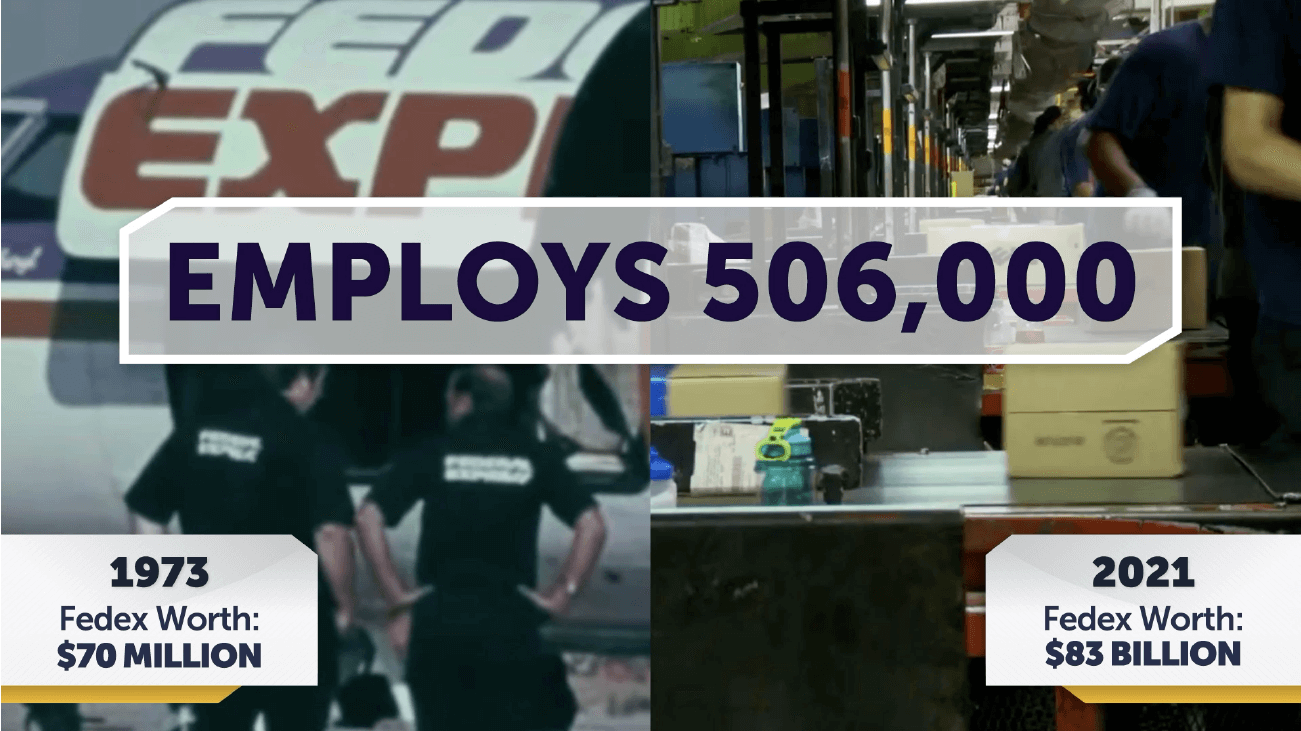

The 1973 oil embargo caused devasting gas shortages and crippling fuel prices.

That didn't stop American innovator Fred Smith from taking the first flight for his new startup,FedEx.

FedEx has since created billions in new wealth for investors…

And today, employs 506,000 people.

In 1975, Bill Gates launchedMicrosoft – while the U.S. was going through the worst recession since World War II.

Today,Microsoft is one of the largest companies around…

With163,000 employees.

And you wouldn't haveAirbnb without the Great Recession.

In 2007, some roommates – low on cash – began renting out air mattresses to people who needed a place to sleep.

Talk about an IPO that shocked Wall Street.

DURING OUR TOUGHEST TIMES, AMERICAN ENTREPRENEURS HAVE BUILT THE COMPANIES THAT REBUILT OUR COUNTRY.

THE NEXT GENERATION WILL LEAD AMERICA'S COMEBACK.

That's why we're here.

We're going to identify those visionaries – and we're going to help them.

With some luck, they could transform their startups into multibillion-dollar companies…

AND YOU CAN PLAY A DIRECT ROLE IN THE CREATION OF TENS OF THOUSANDS – MAYBE EVEN HUNDREDS OF

THOUSANDS – OF NEW AMERICAN JOBS.

Alright, Sohail, you've got our game plan and presentation ready to go…

Sohail:

We do.

Daymond:

Perfect.

Let's get to it.

Today, we're going to take you step by step through our mission.

It was developed by over 100 of the brightest business minds.

WE'RE GIVING YOU A SEAT AT THE TABLE – BECAUSE YOU HAVE AN IMPORTANT ROLE TO PLAY.

So a few quick things before we begin.

You're gonna hear the word "startup" a lot.

Startups are small, privately held businesses.

They're called startups because they're just starting up.

Founders might dream of their companies becomingunicorns– meaning worth at least $1 billion…

Or ringing that bell on IPO day.

But that would happen down the road – if ever.

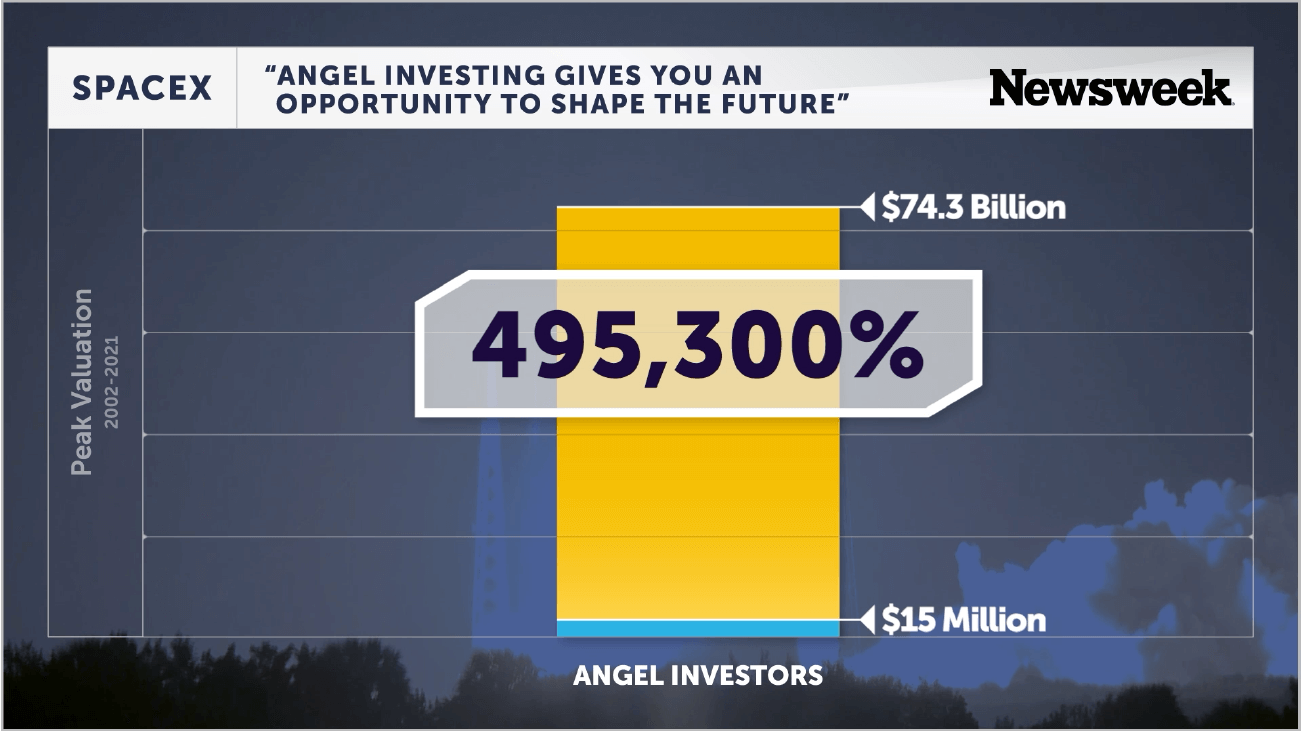

Now, when you're talking startups, you're talking angel investing…

Being one of the very first to bet on those founders.

WE'RE GOING TO COVER THE WHO, WHAT, WHEN, WHERE, WHY, AND HOW OF ANGEL INVESTING.

THERE IS A WORLD OF DIFFERENCE BETWEEN THIS AND INVESTING IN STOCKS.

You see, when you buy shares of some stock, you aren't helping that company win – not really.

You bought your shares from someone else – maybe me or Josh over there.

But when you're an angel investor, you're investing directly into real businesses.

The founders put your money to work right away.

You'll get to know them. They'll ask for your advice.

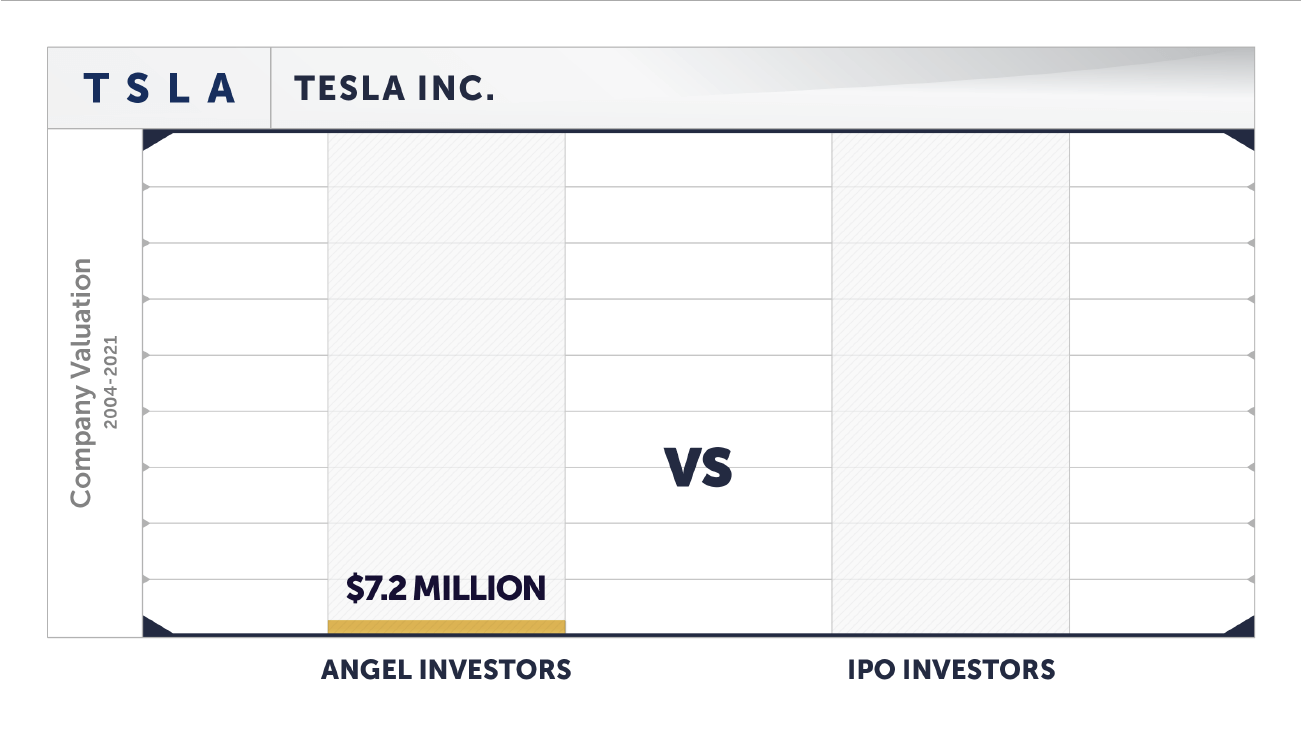

Elon Musk asked his first angels inTesla…

"Hey, what do you think… should we sell our technology toFordandMercedes? Or should we build our own cars?"

If you were one of Elon's angels, you became a part ofTesla'sstory.

Pretty cool, right?

But if you waited 'tilTesla IPO'ed, Elon doesn't even know your name.

NOW, HERE'S THE BIGGEST DIFFERENCE BETWEEN ANGEL AND STOCK INVESTORS.

Tesla's angels were able to invest when the entire company was worth barely $7 million.

It was a lot more expensive for stock investors on IPO day.

And while neither side is complaining…

The angels experienced way more upside…

Because they played a direct role in Tesla's future.

Alright, since you're literally getting in on the ground floor…

These deals are riskier than boring blue-chip stocks.

So what I'm about to say is extremely important – please listen very carefully.

I'VE RECRUITED A TEAM OF ULTRASUCCESSFUL ANGELS AND ENTREPRENEURS FOR THIS MISSION…

INCLUDING SOME OF THE FIRST TO INVEST IN AIRBNB, 23ANDME, ROBINHOOD, AND COINBASE.

We're going to teach you our "1,000X Formula" for identifying deals with the potential to pay out, well…

It's in the name.

But most important, we've joined forces to find the next generation of visionaries who've created the startups that can lead America's Comeback.

I'm also investing $100,000 into the startups we select.

Anything I make from that is going to charity.

We've already identified two incredible startups that passed our test with flying colors.

We'll tell you all about them later.

Josh, that covers the big picture.

LET'S GET THINGS MOVING.

WHY ARE STARTUPS CRITICAL TO AMERICA'S COMEBACK?

Josh:

Startups are a force to be reckoned with.

They generate in the neighborhood of$3 trillion in economic output a year.

That's about eightAmazons… 20Microsofts… or 97Teslas.

And startups put a lot of people to work –creating millions of new jobs every year.

Daymond:

More than Fortune 500 companies, correct?

Josh:

Correct.

STARTUPS ARE THE NUMBER-ONE SOURCE FOR NEW JOBS.

Daymond:

Also, one of the hottest areas for investment.

Josh:

You could argue it's the hottest.

In 1995, investors pushed$7.3 billion into American startups.

Today, it's $148 billion – and that's just in America.

Worldwide, it's $300 billion.

Daymond:

WITH ALL THAT MONEY IN PLAY, YOU'D THINK STARTUPS ARE JUST A BUNCH OF IVY LEAGUE GENIUSES WORKING IN FUTURISTIC LABS.

USUALLY, IT'S JUST A COUPLE OF PEOPLE IN A DINGY OFFICE – OR THEIR HOUSE.

FUBU began in my mom's basement.

That guy – Kevin Plank – startedUnder Armour in his grandmother's basement.

That guy – Reid Hoffman – startedLinkedIn from his apartment.

LinkedIn was once worth $10 million.

WhenMicrosoft bought it, they had to cut a check for $26.2 billion.

And that's Pierre Omidyar.

He launchedeBay from his living room.

Take a guess – what was the first item Omidyar auctioned oneBay?

The answer is…

Sohail:

A broken laser pointer he purchased for $30.

He only made $15.

Daymond:

That deal didn't work out.

ButeBay sure did, didn't it?

Sohail:

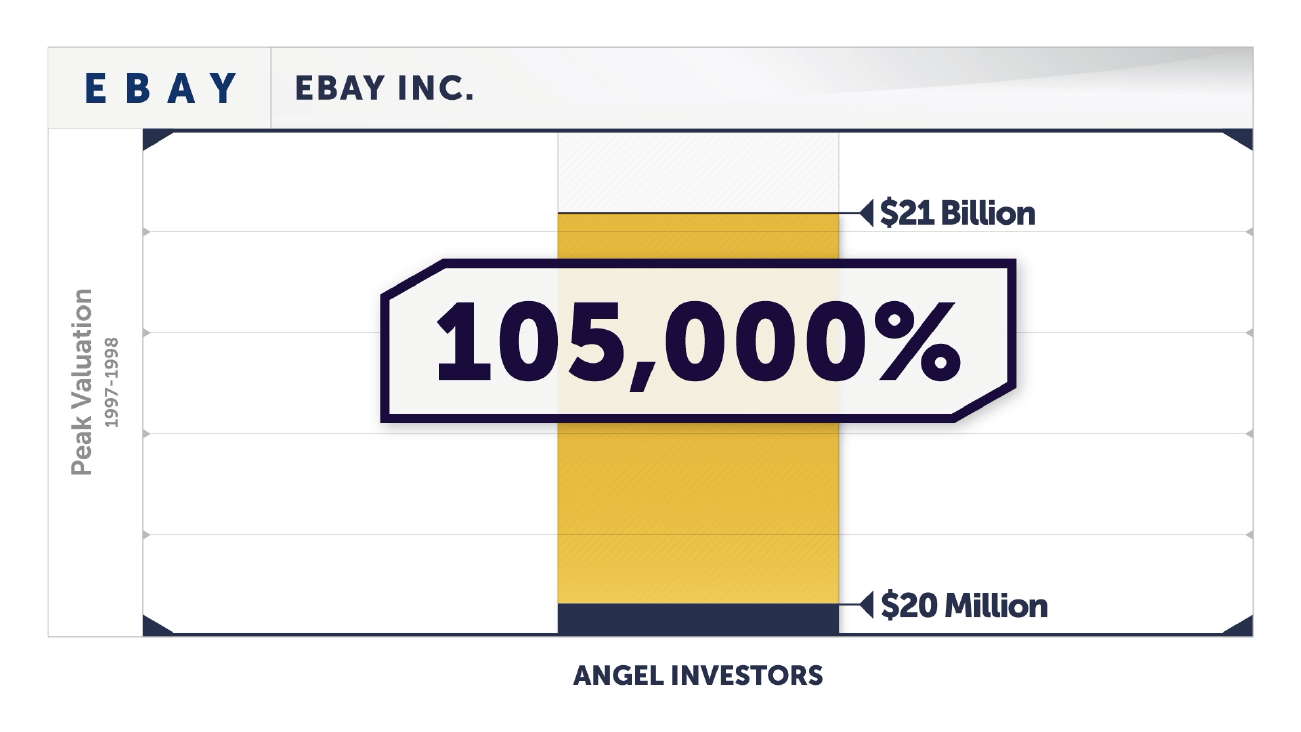

eBay was a true industry disruptor.

It quickly reached a valuation of $20 million.

A year later… $21 billion.

Daymond:

OK, we've got these founders working in their homes and apartments.

Next up…

I have another trivia question.

Where didDisney get its start?

Here's a hint – not on Space Mountain.

Sohail, where?

Sohail:

Same place asApple,Microsoft,Google, andAmazon….

In a garage.

Daymond:

Google even bought the garage to turn into a museum.

Living room, bedroom, or garage…

OVERALL, ABOUT 69% OF STARTUPS BEGIN AT A FOUNDER'S HOME.

THE REST? MANY FROM DORM ROOMS…

Facebookbeing the most famous.

Mark Zuckerberg, some buddies, and a Harvard dorm room.

DropboxandSnap have similar stories.

Entrepreneurs are living the ramen-noodle diet – building their startups.

THEY'RE STRETCHING EVERY PENNY AS FAR AS THEY CAN.

THE MORE MONEY BACKING AMERICAN STARTUPS, THE MORE AMERICAN JOBS THEY CREATE.

Sohail:

The closer you look at the data, the stronger that connection becomes.

Startups with angel investors are more likely to be…

- In business at least four years…

- Hire at least 75 employees…

- Receive a patent for their innovations…

- IPO or get acquired.

Daymond:

But this goes way beyond angels just investing money into startups.

You've watched movies about heroes or superheroes.

To me, the best ones always had a sidekick.

Batman had Robin… Sherlock Holmes had Watson… and so forth.

THINK ABOUT EVERY STARTUP AS ITS OWN MOVIE.

THE HEROES ARE THE FOUNDERS…

THE SIDEKICKS, THEANGEL INVESTORS.

Harvard and MIT created this interesting way to visualize the relationship between founders and angels.

Take us through that – we can use my story.

Laura:

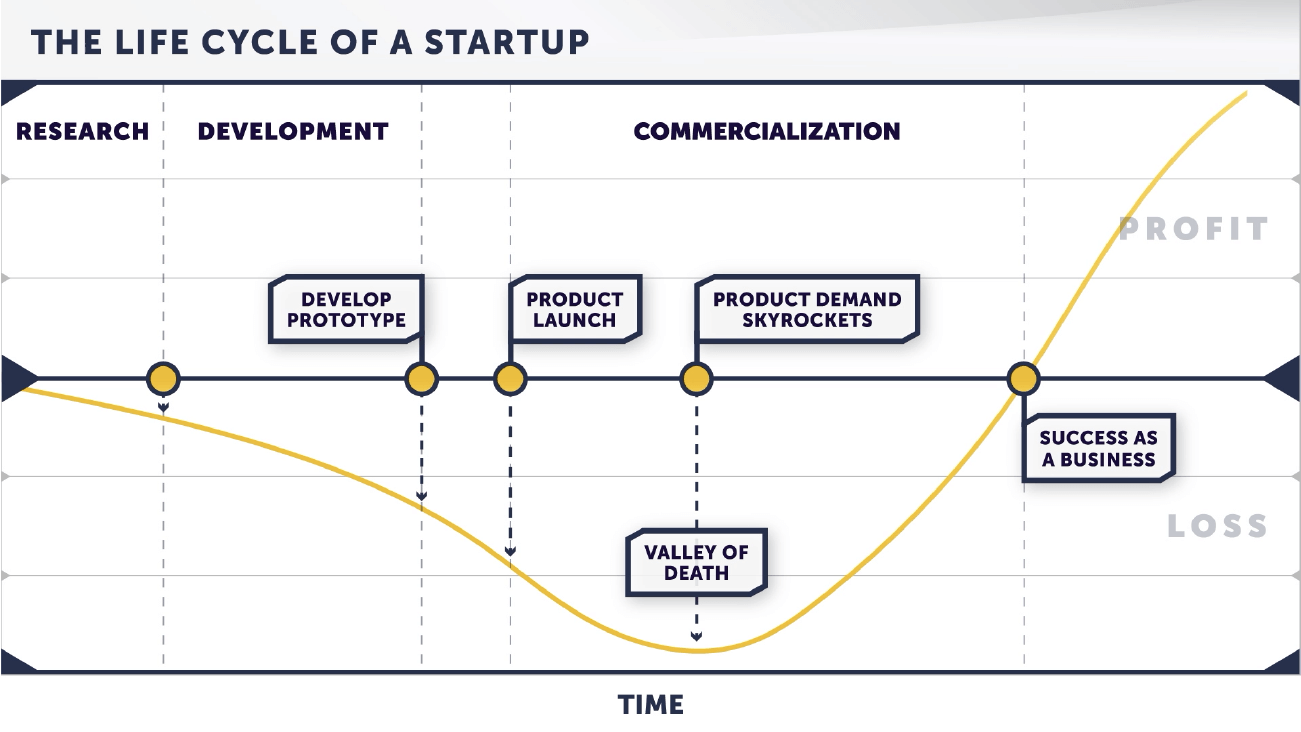

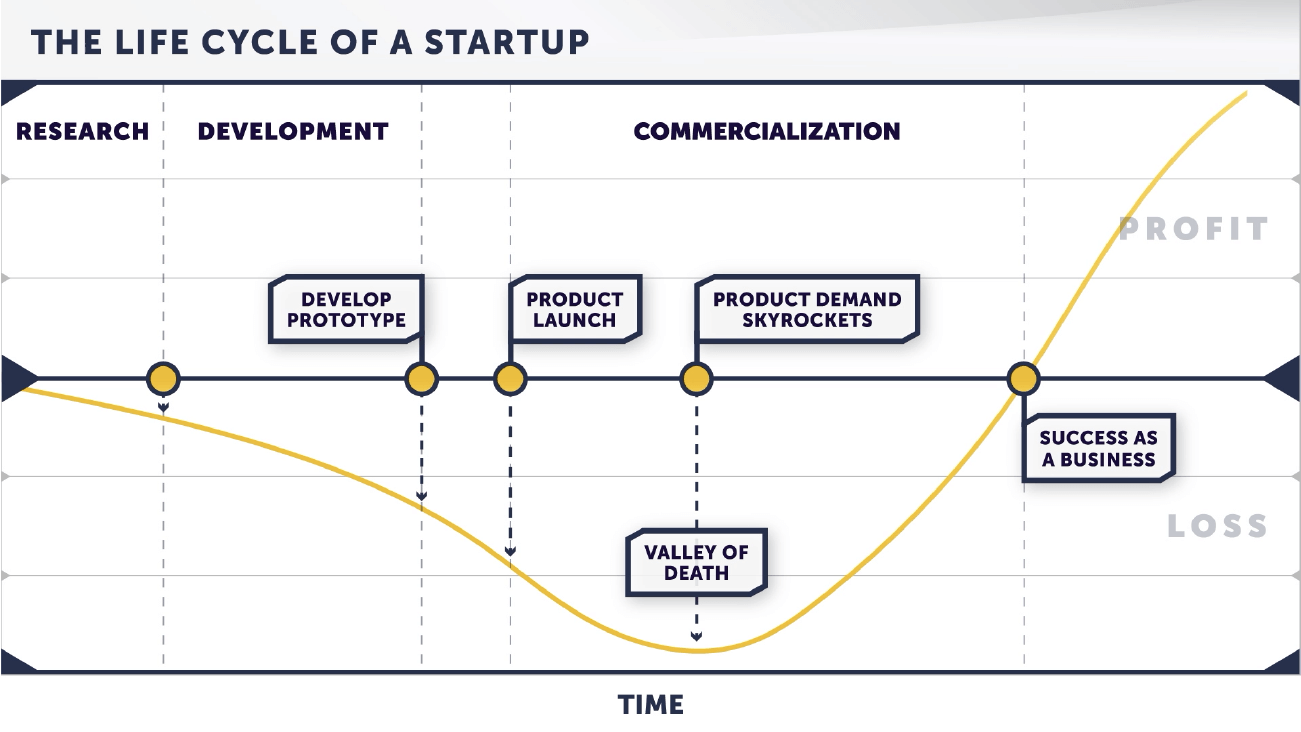

OK, FUBU began as an idea that was sparked by some sort of aha moment.

What was yours?

Daymond:

Growing up in Hollis – to make it, you either had to hustle on the streets, or you had to hustle in business.

Back then, hip-hop music was just starting to explode.

LL Cool J and Run-DMC were from my neighborhood.

They had money in their pockets, fancy cars, and they also wore Timberland boots that all of us wanted to wear.

One day, the CEO of Timberland opens his big mouth – and I have no idea why, but who cares…

He ends up saying "we do not make or sell boots to drug dealers."

The nerve on this guy.

Laura:

There's your aha moment.

Daymond:

More like a "chip on my shoulder" moment.

I wasn't a drug dealer.

I was working my tail off at Red Lobster.

When I saw this, I figured my money wasn't green enough for Timberland – or other hardworking folks' around me, their money wasn't either.

So I decided that I'm gonna make clothes that were for us, by us.

Laura:

That places you here…

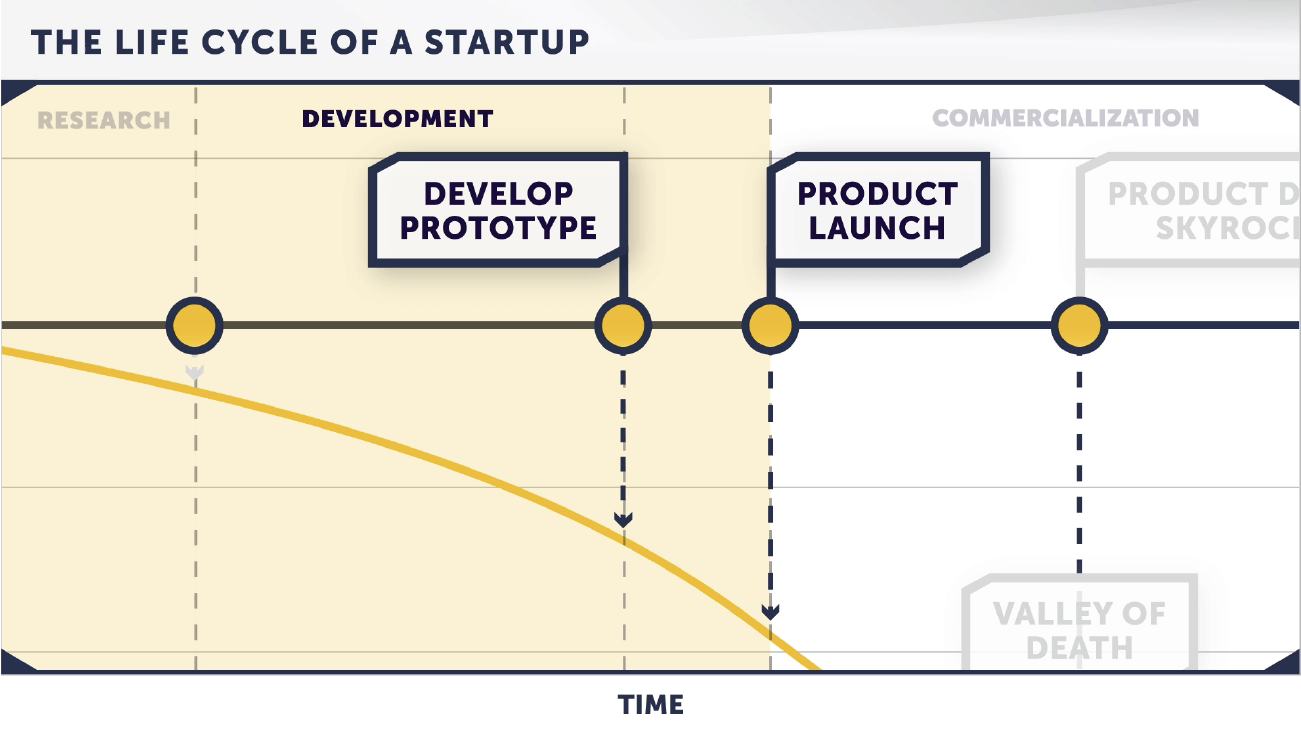

Time to develop prototypes of the clothing and launch version 1.0 of the startup.

Daymond:

Did all of that.

I WAS MAXING OUT CREDIT CARDS, CLOCKING OUT AT RED LOBSTER, THEN GOING RIGHT HOME TO SEW HATS IN THE MIDDLE OF THE NIGHT – ALL THE WAY TO THE EARLY MORNING.

THEN, SELLING THEM OUTSIDE THE MALL WHENEVER I COULD.

Laura:

You launched version 1.0 of your product line.

THIS IS WHEN STARTUPS ENTER WHAT'S CALLED THE "VALLEY OF DEATH."

THEY FACE SOME INCREDIBLE CHALLENGES.

THE FOUNDER BEING THE HERO,THIS IS WHEN THE SIDEKICK ENTERS YOUR MOVIE – AN ANGEL INVESTOR OR INVESTORS.

Together, if they overcome the Valley of Death…

It's the dating appBumble going from $12.66 million to $7.59 billion…

Started after its founder was repeatedly harassed and bullied online.

Or it's like Groupon – founded in 2008 during the recession.

Less than four years later, it was worth over $12 billion.

Of course, if a startup can't overcome the Valley of Death – like many do…

Daymond:

It's over.

Roll the credits.

You know, three times, FUBU almost went out of business.

Laura:

How'd you escape the Valley of Death?

Daymond:

I caught a very big break.

One day, I heard LL Cool J was back in the neighborhood

And I wasn't sure where he was, so I tried his mom's house – and I found him outside in a limo.

I convinced him – more like begged LL Cool J – to wear my T-shirt for a quick photo.

It was like hitting the lotto.

I sent that photo to all the major retailers.

Then, I snuck into a fashion convention and landed $300,000 in orders.

They had all seen that photo.

Now, I gotta get some money to buy equipment, hire a few buddies, and fill this huge order.

The problem? I was broke as a joke.

Laura:

Time to get that sidekick.

Daymond:

Exactly.

Laura:

Your first angel investor was your mother?

Daymond:

Of course.

Weren't many venture capitalists wandering 'round the hood those days.

Mom gave me some money.

I TURNED HER HOUSE INTO A MINI CLOTHING FACTORY – SEWING MACHINES, SEAMSTRESSES, THE WHOLE NINE YARDS…

AND I BURNED THROUGH HER MONEY QUICK.

THIS IS WHERE AN ANGEL INVESTOR'S VALUE GOES BEYOND WRITING A CHECK.

Mom had a brilliant idea. She goes…

"Why don't you take out an ad in the newspaper."

Even gave me the headline…

"Million Dollars in Orders. Need Financing."

It changed everything. Sure, a couple of hustlers called…

But then, the phone rings – it's Samsung's textile division.

And they said if I can sell $5 million of FUBU in three years, they'd continue to finance the manufacturing and distribution of FUBU products.

IT DIDN'T TAKE ME YEARS.

I SOLD $30 MILLION IN THE NEXT THREE MONTHS AND NEVER LOOKED BACK.

TWO YEARS LATER, FUBU'S SALES REACHED $350 MILLION.

Laura:

You escaped the Valley of Death – your products and business were a success.

Daymond:

I can say with absolute certainty that success didn't happen without my angel investor – mom or not…

THE BOND BETWEEN ANGELS AND ENTREPRENEURS IS VERY PERSONAL.

THEY'RE WILLING TO RISK BACKING COMPANIES AT THEIR EARLIEST STAGES.

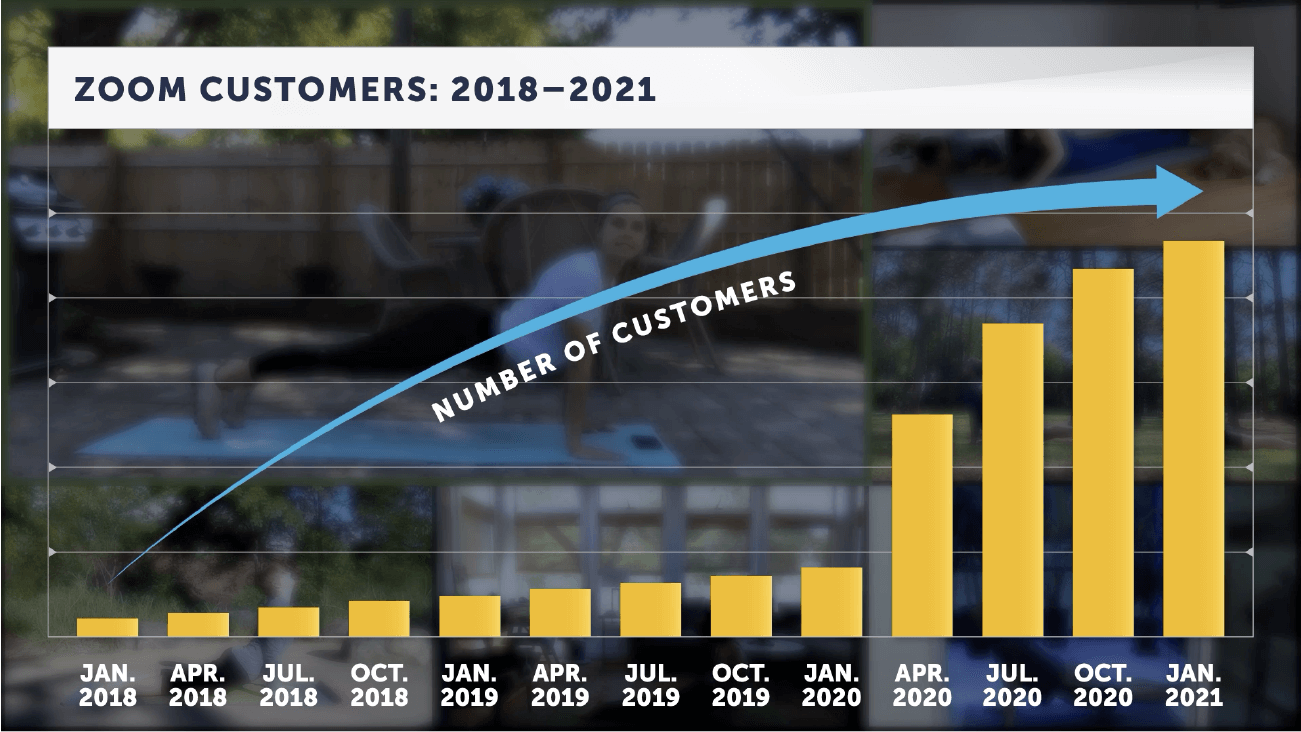

I mean, how many people had heard of eitherModerna orZoom before COVID?

Josh:

Probably not many.

Daymond:

Yeah. But onceModerna rolled out their vaccine, and everybody was using Zoom for video calls, they became household names.

Their angel investors made that possible.

Josh, how were they rewarded?

Josh:

Handsomely.

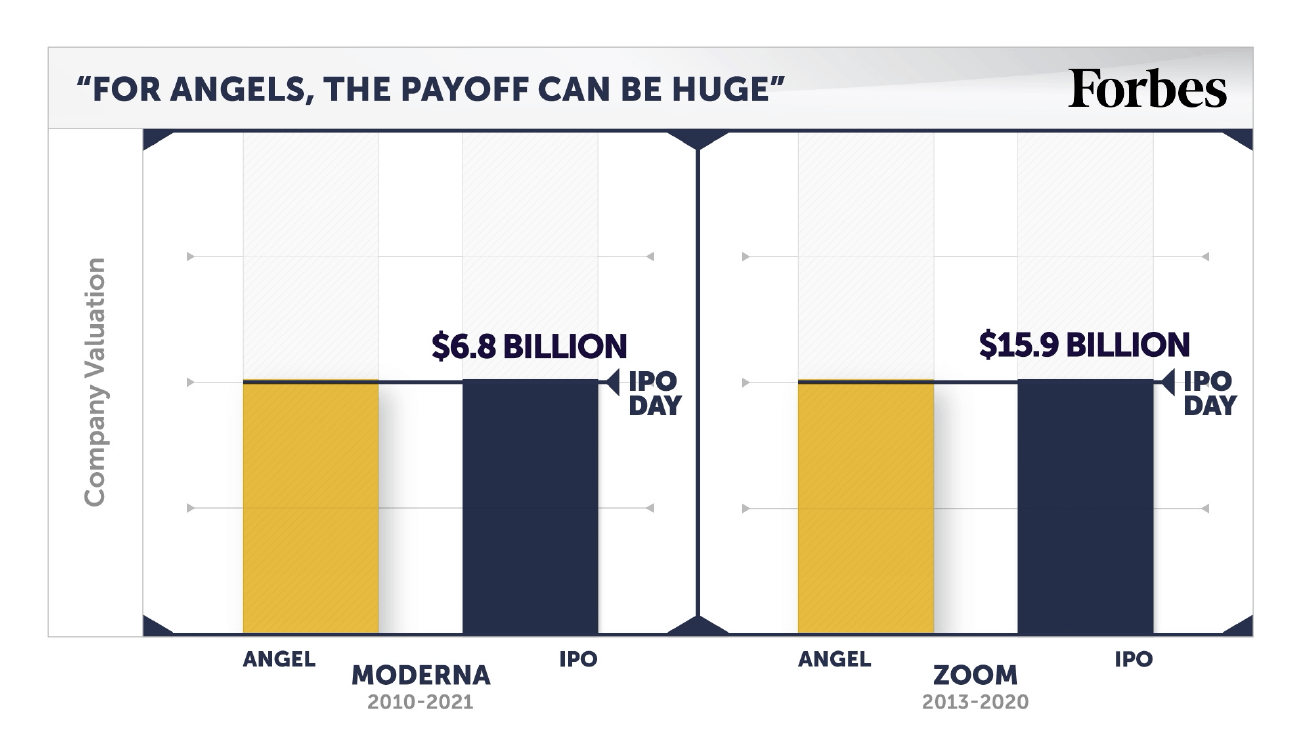

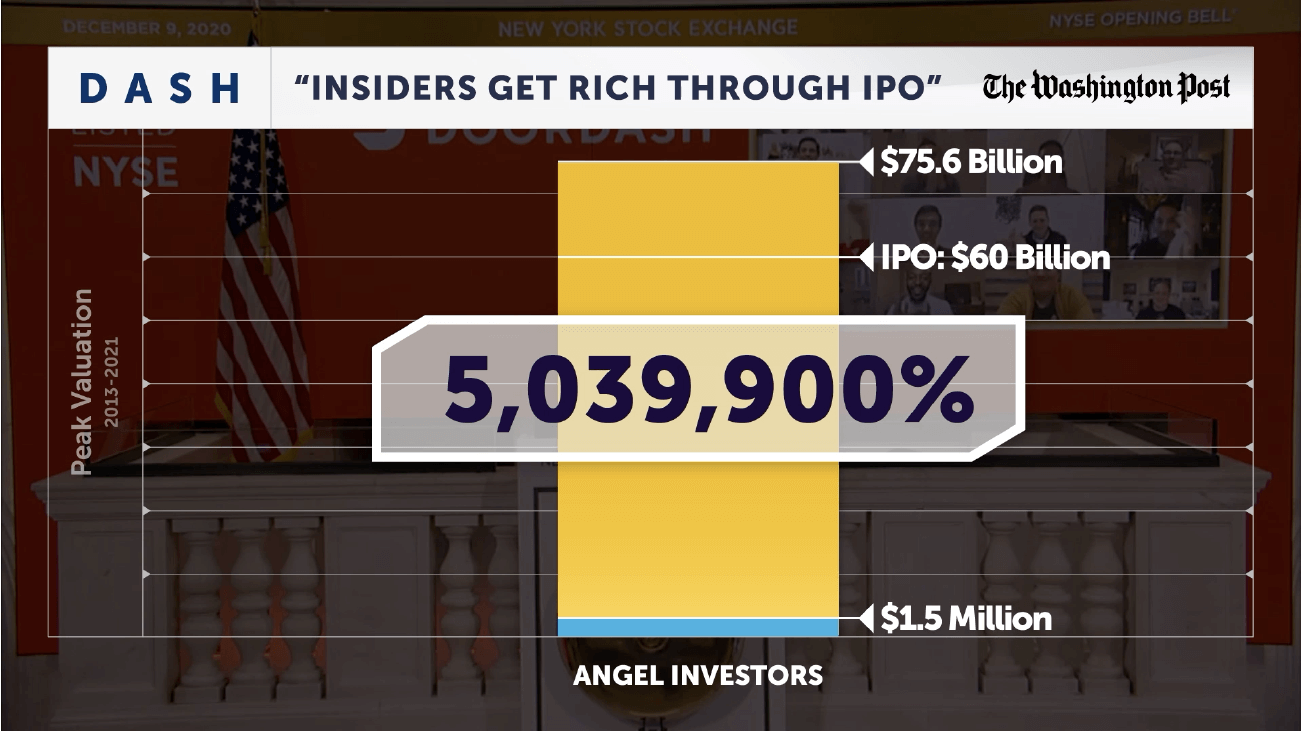

USUALLY, BY THE TIME A COMPANY IPOS, 95% OF THE GAINS HAVE BEEN TAKEN OFF THE TABLE BY ANGEL INVESTORS.

Moderna andZoom were no different.

The first angels backedModerna when the company was worth just $10.5 million.

Zoom… $24.5 million.

Stock investors had to wait until both were worth billions…

And you can see who was looking at generational wealth.

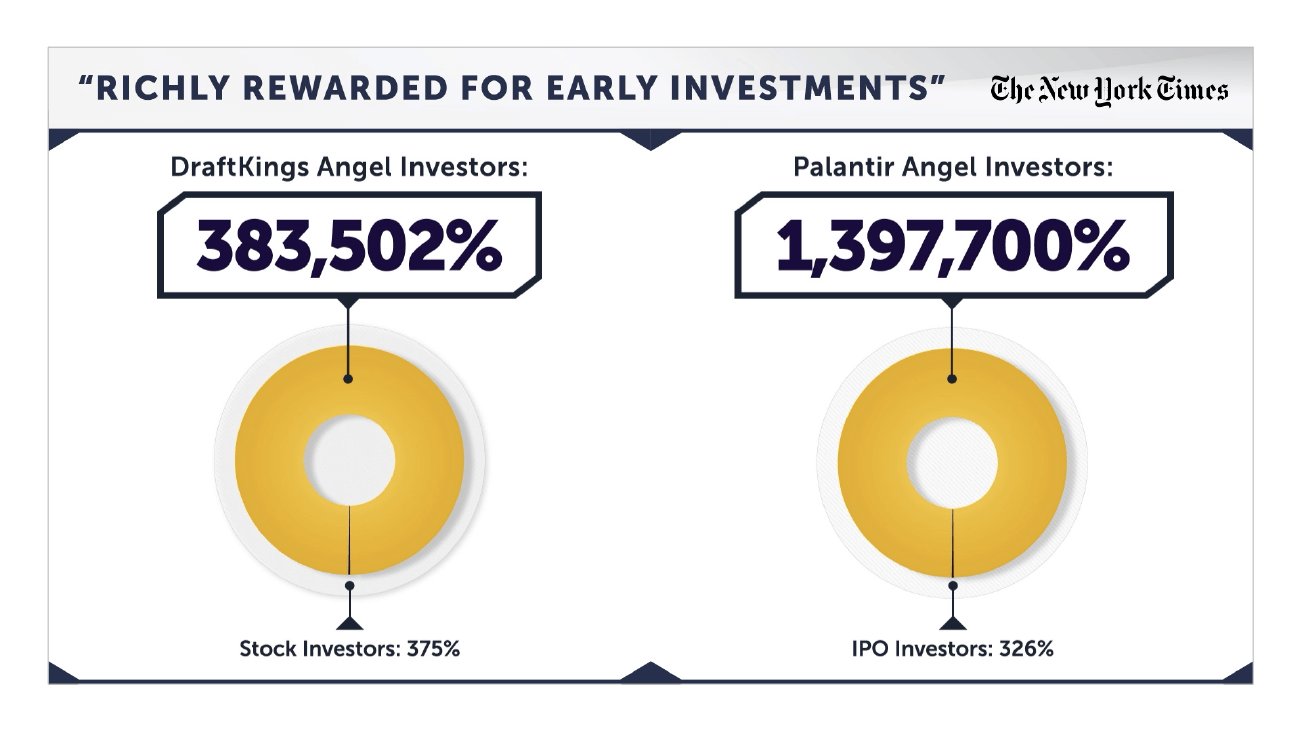

Similar outcome withDraftKingsandPalantir – two very different stocks.

DraftKings is in fantasy sports.Palantir is in big data.

Both made angels much happier than stock investors.

Daymond:

Look at it this way.

Which piece of the pie would you prefer?

That tiny sliver – or almost the whole pie?

What about now?

Or how about now?

TIME AND TIME AGAIN, THE ANGEL INVESTORS FEAST ON GENERATIONAL WEALTH OPPORTUNITIES.

EVERYBODY ELSE FIGHTS OVER THE TABLE SCRAPS.

So why isn't your neighbor, second cousin, or best friend doing it?

Sohail, why don't you take this one.

Sohail:

No problem.

FOR CENTURIES, IT'S BEEN THIS ALMOST SECRET MARKET CONTROLLED BY THOSE WHO HAD THE WEALTH, THE CONNECTIONS, AND THE POWER.

For instance, here we have Arthur Rock – a prolific venture capitalist.

Rock cut a $10,000 check to getIntel off the ground…

Serious money back then.

Daymond:

Still is today.

Sohail:

That gamble paid off – made him a billionaire.

His next gamble did too.

Arthur Rock and his buddy Mike Markkula had the guts to bet on this crazy guy – Steve Jobs.

That's Markkula in the picture.

Daymond:

Check him out – smiling from ear to ear.

Sohail:

WhenApple IPO'ed, Markkula was looking at a $203 million windfall.

Daymond:

He knew what was coming.

Sohail:

Dave Marquardt must've had a crystal ball too.

In 1981, he bet on a visionary named Bill Gates and his startup,Microsoft.

On IPO day, he owned more than 5% of the company.

Daymond:

Can you imagine owning that much ofMicrosoft?

And he made a killing selling chunks whenever he felt like it.

$2 million here – $5 million there.

A modest $10 and $13 million.

That's not even counting the dividends.

Sohail:

No it isn't.

More recently, you had Peter Thiel as Mark Zuckerberg's first angel investor.

Thiel owned about 10% ofFacebook…

Before it had booked $1 in revenue.

Eventually, Thiel unloaded a block of his shares for over $1.1 billion.

I'll mention one more – Chris Sacca. He's been on TV with you a bunch.

His job atGoogle opened all the doors with…

Twitter,Facebook,Instagram – to name few.

All were tiny, unknown startups when he got in.

Before angel investing, Sacca's net worth was nearly zero.

It made him a billionaire.

Daymond:

We could tell stories like these for days.

This is what ticks me off.

WE HEAR HOW MAIN STREET IS THE BACKBONE OF OUR ECONOMY.

BUT IT'S MAIN STREET AMERICANS WHO'VE BEEN SHUT OUT OF THESE GENERATIONAL WEALTH OPPORTUNITIES.

Josh, talk about when the game changed…

Josh:

It changed when Congress stepped in and passed the JOBS Act.

This opened the floodgates.

TODAY, OVER 240 MILLION AMERICANS ARE QUALIFIED TO BE ANGEL INVESTORS – WHETHER THEY REALIZE IT OR NOT.

Daymond:

IT USED TO BE THAT YOU HAD TO TOSS $50,000, $500,000, OR $5 MILLION INTO A HOT STARTUP.

NOT ANYMORE.

$50 CAN GET SOMEONE IN ON THE ACTION.

Even that little bit can go a long, long way.

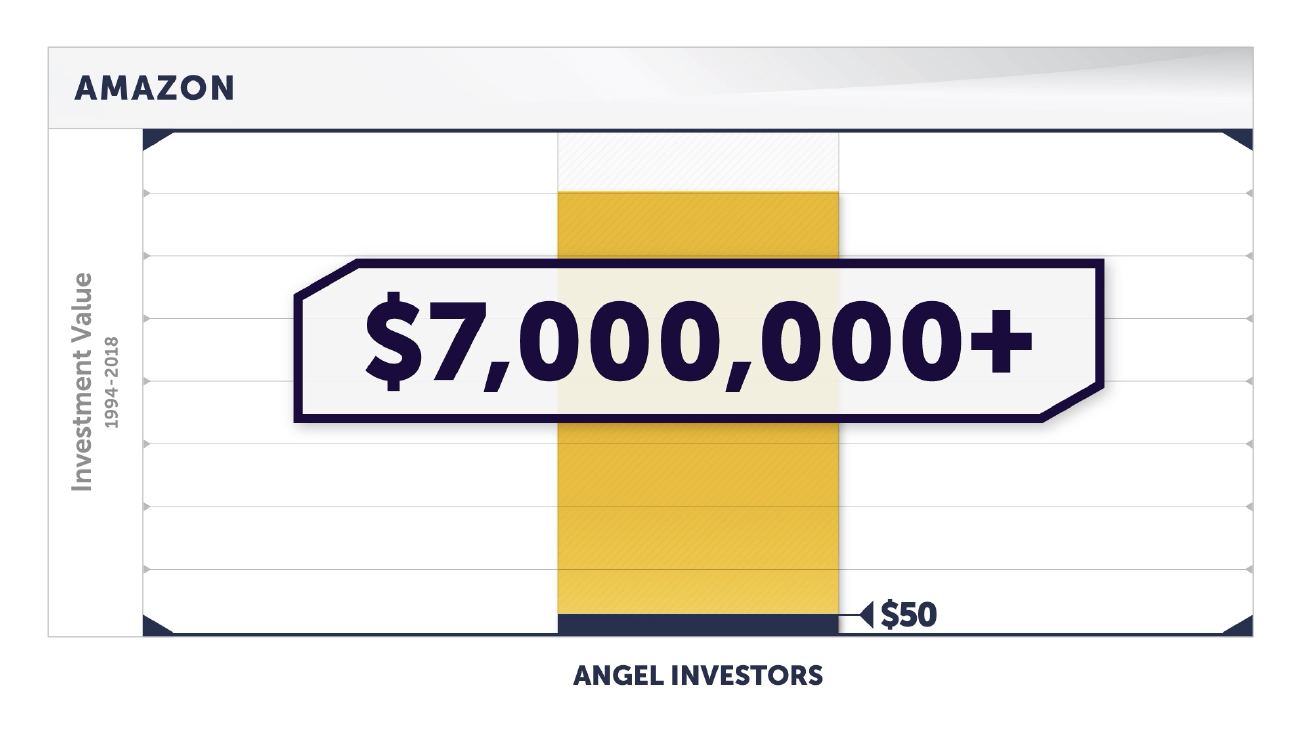

When Bezos had that idea calledAmazon that started up in his garage…

He had 22 angel investors backing him.

In 2018, those shares would've been up 14,000,000%.

If somebody was given the chance to toss just $50 intoAmazonas a startup, they would've had over $7 million.

$500 would've landed them over $70 million.

Still, any investment can lose you money.

But you never bet the farm on a single startup.

If you have $500 to invest, split that up into 10 separate deals – if you want.

If you do this right, study after study has shown you could absolutely destroy stock market returns.

Now, Laura, the Federal Reserve's findings were absolutely amazing and extremely impressive. Let's talk about it.

Laura:

By far, the best study.

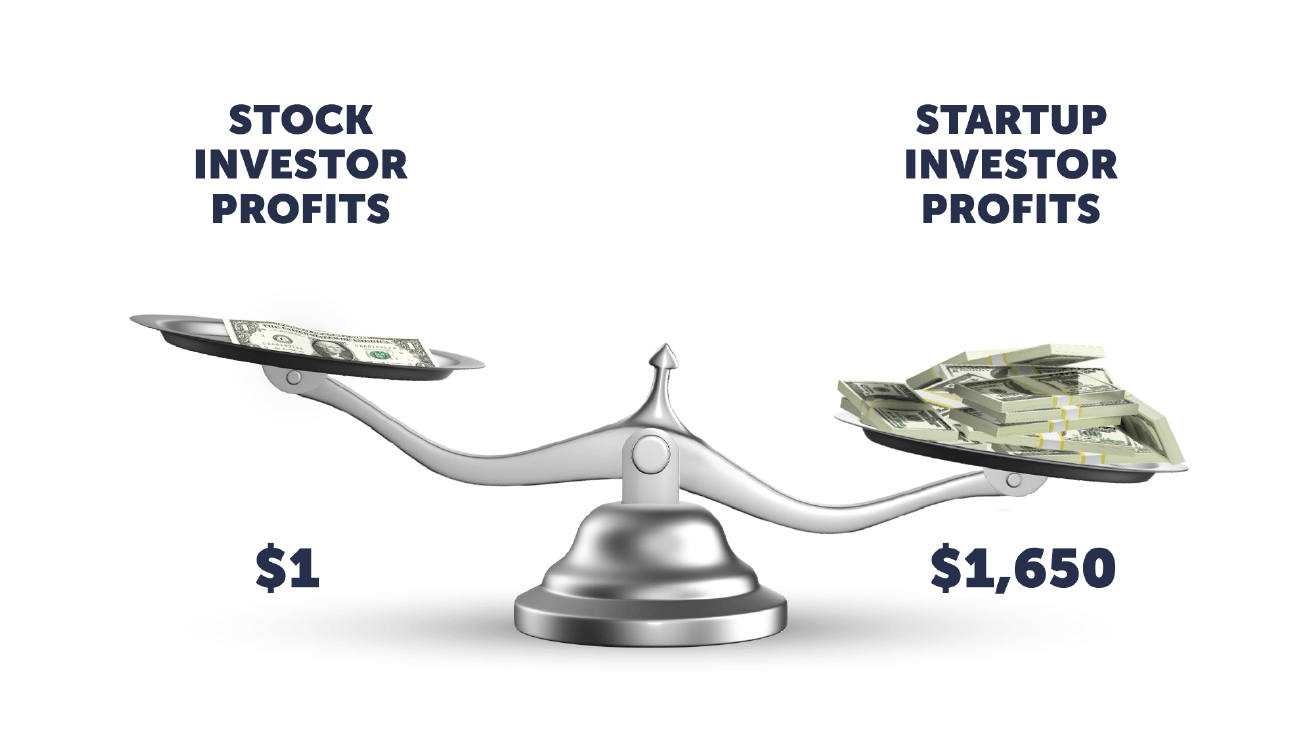

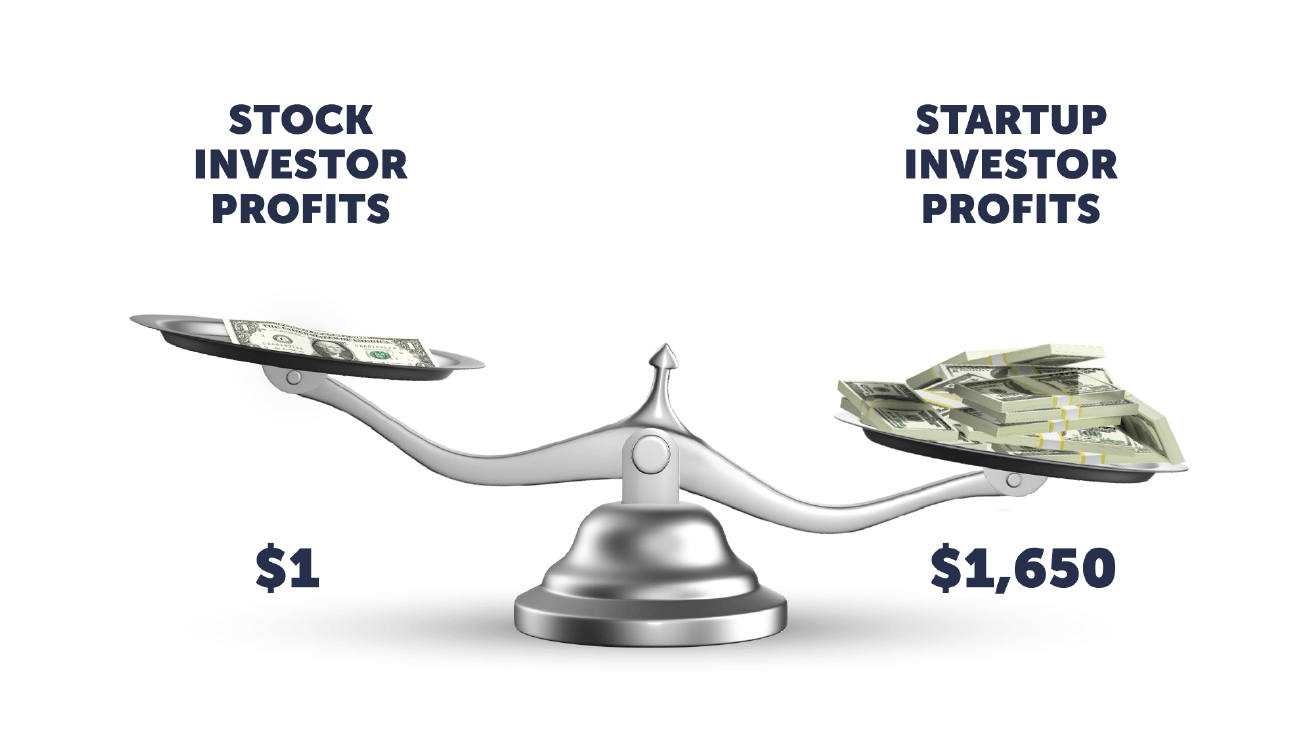

THEY COMPARED 35 YEARS OF STARTUP AND STOCK RETURNS.

THEIR DATA REVEALED STARTUPS PRODUCED PROFITS 1,650X GREATER THAN STOCKS.

Daymond:

Take a second to consider that.

EVERY $1 A STOCK INVESTOR MADE IN PROFITS, AN ANGEL INVESTOR COULD'VE MADE $1,650.

Or how about this

Every time a stock investor made $100, they could've bought a nosebleed ticket to a Lakers game on a weeknight…

And the angel investor made enough to rent out the entire Staples Center for about a day and a half.

Congress did their part – opening a door for most Americans to get into angel investing.

But they couldn't open the most important door preventing them from making a fortune at it – because they can't.

If you're new to angel investing, you could have $50 – or all the money in the world – burning a hole in your pocket.

If you want to get in on the next Uber…

or Airbnb…

or SpaceX…

someone's gotta open those doors for you.

THAT'S CALLED DEAL FLOW.

As you can see on the monitor, this is deal flow.Josh:

Yeah, the venture capital firms have had their pick of the litter for years – the hottest startups.

This is a snapshot of Andreessen Horowitz's portfolio…

One of the most powerful VC firms in Silicon Valley.

Daymond:

Look at all those unicorns.

Josh:

Next, we have a glimpse insideSequoia Capital's portfolio.

Apple,Google, andCisco…Sequoia landed them all before they IPO'ed – when they were unknown startups.

Daymond:

These guys have done a good job boxing out newer angel investors.

Deal flow means you're invited to invest in the hottest startups by the founders – and by VCs likeSequoia.

Check outSequoia's portfolio – you seeUber?

Sequoia shared that deal with some of their buddies.

One angel got in whenUber was worth around $5 million…

Cut a check for $25,000.

Five years later, his stake was worth $110 million.

Now, Josh, did I ever tell you that I passed onUber?

Josh:

That's gotta keep you up at night.

Daymond:

Nah, because I'd rather miss one good deal than chase 100 bad deals.

The important thing is though, I got invited to that deal in the first place.

BECAUSE I'VE GOT DEAL FLOW.

THE PEOPLE JOINING OUR MISSION DO TOO…

AND WE'RE OPENING THOSE DOORS FOR YOU.

So let's say you were one of the first to back a startup.

Now, it's setting the market on fire…

And you want to cash out.

Tell us about exits.

Sohail:

There are more than a few ways for angels to make serious money.

We'll focus on two major types of exits.

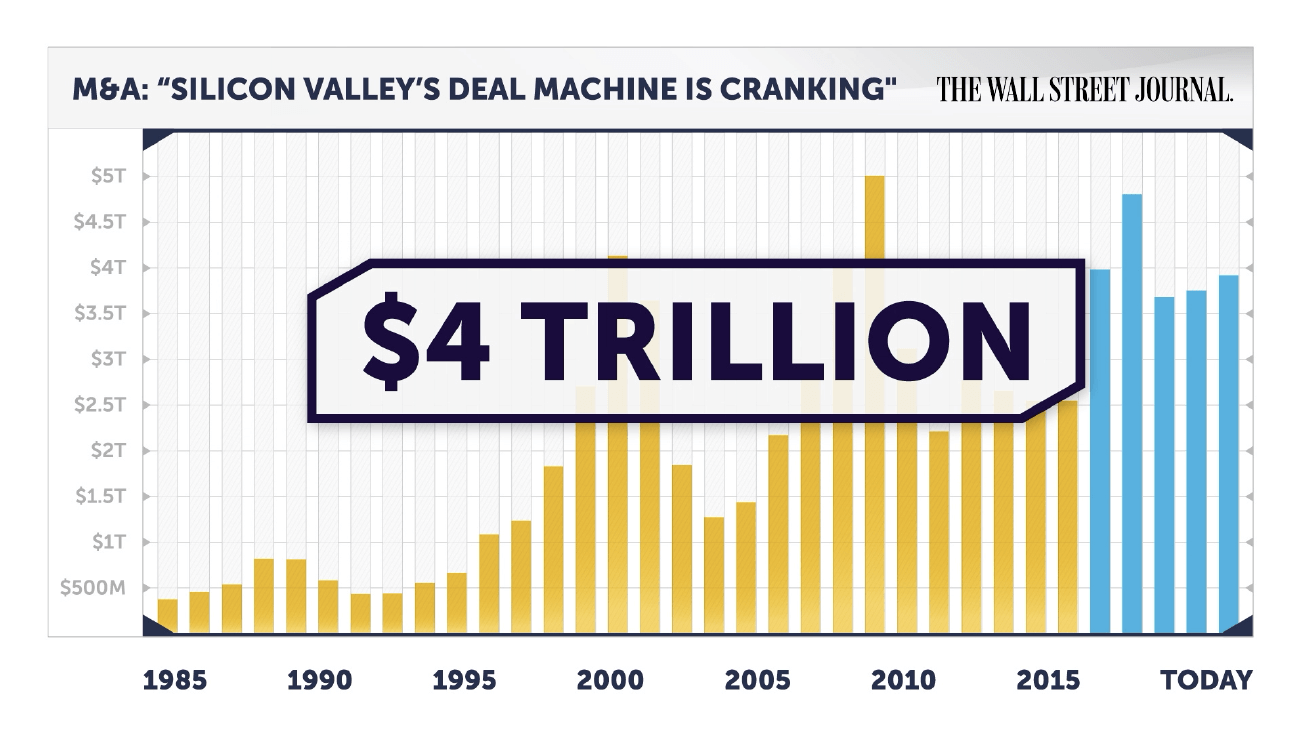

M&A – mergers and acquisitions…

And going public – or IPO'ing.

M&A has been on a tear – with companies spending $4 trillion some years.

Daymond:

The pandemic was devastating for traditional restaurants…

But not the startups delivering the food from those restaurants.

Their revenue doubled and they became very attractive M&A targets.

Sohail:

Grubhub set off an actual bidding war.

At launch, it was barely worth $1 million.

Then, it was scooped up for $7.3 billion.

Daymond:

When angels joke about making private-island money, that's what they're joking about.

Uber loses that bidding war – did they sit around and pout?

Sohail:

No, they didn't.

They acquiredPostmatesfor $2.65 billion.

Daymond:

That gave the angels a story to tell their grandchildren.

Sohail:

You bet they did.

Daymond:

Startups seem to be breaking records with their IPOs lately too.

Sohail:

DoorDash's $60 billion IPO shot up – thanks to all that M&A we were just talking about with food delivery startups.

Video games and esports have been another hot area.

We haveRoblox– a gaming network where developers create their own virtual worlds.

Roblox was once worth $1.5 million.

On March 10, they IPO'ed at $29 billion.

Daymond:

Everybody has been talking about SPACs lately.

They're an even faster way for startups to go public.

Their pitch to investors sounds insane…

"Hey, give us your money – we don't know which startup we're gonna buy yet… but you'll be the first to know when we do!"

Then, they dump that pile of money in front of a startup, and they merge.

Laura, SPACs have actually been on fire lately, haven't they?

Laura:

Absolutely.

Virgin Galactic, DraftKings,and Quantumscape were three of the more famous SPAC deals…

And the winners have been their angel investors.

Investments soared to $83 billion last year – more than the prior decade combined.

Daymond:

Not all startups have the goods to deliver a profitable exit.

Fortunately, separating the winners from the wannabes isn't rocket science.

WITH OUR MISSION, WE'RE GONNA USE A VERY SIMPLE FORMULA – OUR 1,000X FORMULA.

RIGHT IDEA… AT THE RIGHT TIME… WITH THE RIGHT TEAM.

Great angel investors lean on their gut instincts. This formula taps into those instincts.

Laura, let's apply it to the real world.

Laura:

Alright.

Here are two videos.

On the left, a flying taxi. On the right, a scooter.

Before the pandemic, major cities were getting pretty crowded.

That trend is only gonna continue.

People need to get from point A to point B as fast as possible – especially if they're commuting to their jobs.

Solving this challenge is part of an industry called micromobility.

Great work.

Daymond:

Take another look at those videos.

Which is the right idea for solving that micromobility challenge?

It's a trick question.

The answer is: Both of them.

IF YOU WANT TO IDENTIFY A 1,000X STARTUP, YOU HAVE TO ANSWER ANOTHER QUESTION…

IS NOW THE RIGHT TIME?

Please continue.

Laura:

Four years ago, scooters being the hottest thing in Silicon Valley was absurd to most people.

But to Bird'sangel investors, it was the right time.

Fastest startup to ever become a unicorn – under a year.

Daymond:

It was the right idea at the right time.

But if you waited 'til now to get intoBird, you might've missed the boat.

Now, Josh, how about those flying cars…

Josh:

Startups have already built 135 different prototypes.

Daymond:

Anybody here trying to volunteer to fly in one of them?

Analysts:

No way…

Daymond:

Me neither.

But that's not the point.

When the founder ofJoby Aviation first pitched to angels, what was Joby worth?

Josh:

About $23 million.

Daymond:

What about when the founder ofLinkedIn did that SPAC deal to takeJoby public?

Josh:

See for yourself.

Daymond:

That's the point.

So why does this startup appear to be winning the flying car race?

WHAT'S THE FINAL PIECE OF THE 1,000X FORMULA?

THE RIGHT TEAM TO GET THE JOB DONE.

That's what separates the winners from the wannabes.

TheRock Star Principle is a theory first developed in the 1960s.

Bill Gates believes rock stars are infinitely more valuable than an average person for a job…

Because they see different solutions than everybody else for the same problems.

It's no coincidence the rock-star founder of LinkedIn – Reid Hoffman…

Is the same rock star with the SPAC behindJoby Aviation.

Also, no coincidence – he was on this team of rock stars.

PayPalhad the right idea at the right time.

And talk about the right team…

That guy in the front is billionaire Peter Thiel.

The most famous member isn't even in this photo – Elon Musk.

Here he is having lunch with the other "richest guy in the world."

Musk foundedTesla– and he's dominating electric vehicles…

AndSpaceX – and he's dominating the space race.

HisBoring Company is digging tunnels to shuttle electric cars around cities…

HisNeuralinkwill give our brains superpowers to compete with artificial intelligence…

AndStarlinkis launching those tiny space satellites.

ROCK STARS – LIKE THESE GUYS – ARE PRETTY GOOD AT IDENTIFYING OTHERS.

SO LET'S MEET SOME ROCK-STAR ENTREPRENEURS AND ANGEL INVESTORS WHO ARE JOINING OUR MISSION.

Alright, why don't we patch David in.

David Weisburd – great to see you!

David:

You too, Daymond.

Daymond:

Why don't you give me a second to brag about you.

David:

Just don't go too overboard.

Daymond:

You've been a rock-star founder since high school.

In 11th grade, you invented a program that trickedPayPal.

David:

10th grade.

Daymond:

OK, 10th grade.

Even better.

PayPal would prepay for tickets to sporting events, and your program instantly flipped them to StubHub.

MADE YOU A MILLIONAIRE BEFORE YOUR 21ST BIRTHDAY.

IT WAS JUST ONE OF NUMEROUS STARTUPS YOU FOUNDED AND SOLD FOR TENS OF MILLIONS OF DOLLARS.

PayPal co-founder, Peter Thiel, even became one of your first angels.

David:

Wild, right?

Daymond:

It really is.

Then, you became an extremely successful angel investor.

You gotta be climbing the ranks of the best of the best.

Then, you decided to launch SPACS.

We have some footage of you ringing the Nasdaq bell for one of them..

You looked pretty happy that day.

David:

Well, it was quite an experience.

That was for10X Capital Venture Acquisition.

Full disclosure: I'm the chief operating officer of that SPAC.

And yes – I was very happy when we went public.

It gave our firm the ability to pursue a merger with an electric vehicle startup calledREE.

Daymond:

The size of that deal turned some heads – even mine.

The press reported it was worth $3.1 billion.

Why an electric vehicle startup?

David:

WE'RE STILL AT THE BEGINNING OF THE ELECTRIC VEHICLE STORY.

THE POTENTIAL MARKET FOR ELECTRIC VEHICLES – WHAT WE CALL THE TOTAL ADDRESSABLE MARKET, OR TAM – PROJECTS TO HIT $802 BILLION.

And overall, something like 70% of Americans are interested in buying them.

Now until recently,Teslawas the standard bearer for EVs.

But they're facing some intense competition from a new generation.

Not to mention the legacy brands likeFord,Toyota, andGM are also introducing some impressive models as well.

Daymond:

Last year, electric vehicles captured a larger share of the U.S. automotive market than ever before.

I'd say there's a growing consensus they are superior to gas- or diesel-powered vehicles in so many ways.

I love howRivian trucks can do a 360 in place.

Never seen a regular truck do that.

And some EV trucks perform like sports cars.

Car and Driver Magazine has tested zero-to-60 times for probably every major gas-powered pickup truck.

The fastest they ever recorded was 3.7 seconds.

TheRivian electric pickup truck has a zero-to-60 that clocks in at three seconds.

TheTesla Cybertruck can reportedly do it in 2.9 seconds flat.

David:

We're witnessing the beginning of a new arms race.

So instead of investing in one EV startup…

We targetedREE Automotive…

Who is developing the tech platform many EVs will need to run on.

There's plenty to like aboutREE…

Such as the fact they're focused on a growing market segment – commercial vehicles.

Look at the platform for vehicles with standard combustion engines or most EVs – you're likely to see components sticking out everywhere.

REE's is flat…

Because they installed all the critical components at the corners of the vehicle – alongside the wheels – for steering, braking, suspension, and the power train.

This makes theREE platform modular.

It can be quickly customized for cars, vans, and trucks of all sizes.

It's even designed to work with any self-driving vehicle.

REE will also have AI that monitors the platform to detect any problems.

That's why we love the company. It's a truly powerful differentiator.

Daymond:

REE had the right idea with its modular platform.

Definitely the right time as well

Fast-growing market with significant revenue growth opportunity.

What made theREE the right team?

David:

Well, it's their two brilliant founders and their team of top engineers from firms such asTesla,Fisker,Arrival,GM,Ford, and many others.

They have attracted investment from large multinationals such asMitsubishi,American Axle,Musashi – which is a unit ofHonda – andMagna – which is the largest automotive supplier in North America

Daymond:

So these major players backedREE, and that's a good sign.

The $802 billion EV market is quickly becoming just a drop in the bucket of something much bigger.

In 2004, the entire world spent barely $33 billion on clean energy investments.

Last year though, they spent more than $500 billion.

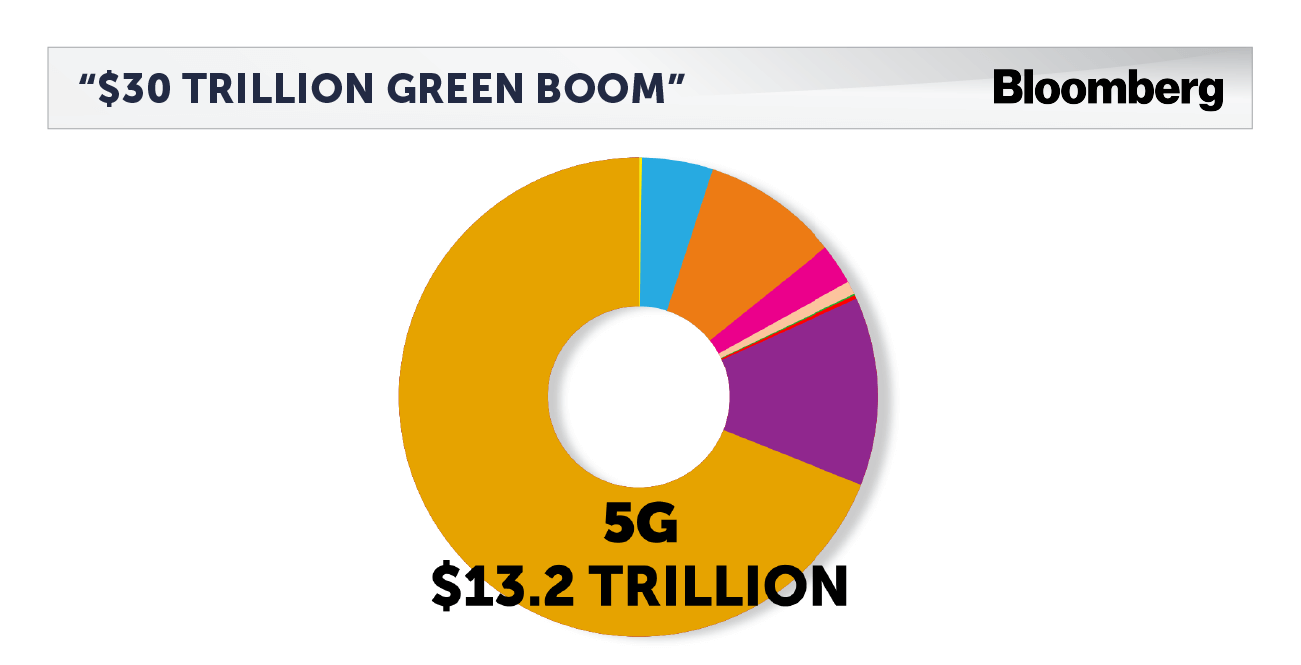

NOW, FIRMS LIKE BLACKROCK AND GOLDMAN SACHS HAVE IT REACHING $30 TRILLION.

David:

The pandemic has really opened the eyes of a lot of people.

During which time, nearly 90% of new power generated came from clean energy.

Just two weeks into the lockdowns – when gas-powered cars disappeared from the roads and the coal plants went quiet – air pollution in China fell 25%.

50% in France, Italy, and Spain.

It also dropped in the U.S. too.

Daymond:

Integrating clean energy into American infrastructure projects has become a focal point for our government – and major investment firms as well.

David:

If you ask me, it's where we'll find the most promising unicorn startups opportunities.

Daymond:

True. Let's dig a little deeper on this.

You can't have the mass adoption of electric vehicles if it takes an hour at one of those stations to recharge them.

David:

Fixing that will require the mass expansion of charging networks at businesses, grocery stores, malls, rest stops…

And it will also require new technologies to speed up how fast those cars can charge.

Right now, startups are building drive-through facilities that'll automatically swap out your battery and give you a fully charged replacement in 10 minutes.

Battery tech for EVs projects could hit $18.5 billion a year.

Daymond:

Which means new American jobs.

David:

Exactly – and lots of them.

Daymond:

And if more Americans are driving EVs, they aren't paying to fill up their tanks.

David:

So why even pay an electric bill to charge them at home?

That's why the revenue estimated for solar power installations is an estimated $2 trillion.

Daymond:

That means even more American jobs.

But let's say the sun doesn't shine for a few days.

David:

Startups are building supercharged battery storage systems…

That could be good for half a trillion dollars a year.

Let's keep following that trend.

Those smart electric cars are connected to smart homes and smart farms.

Solar and wind are set to overtake coal and gas on our power grid.

That requires nationwide upgrades to a smart power grid.

And if we're going big on smart grids…

That will lead to more smart city applications.

When we walk around those smart cities – or we're inside smart homes – we're connected by smart devices.

So we'll need exponential growth in our 5G capabilities.

That's maybe another 23 million new jobs right there.

ANGEL INVESTORS ARE AT THE BEGINNING OF A MOVEMENT SO BIG – IT'S HARD TO IMAGINE ANYTHING BIGGER.

Daymond:

David, I am so proud and so excited that you're bringing your Deal Flow to our mission.

David:

Me too.

Daymond:

Back in 2022 – before you turned 30 – you had invested in four of the top 15 startups on the Wall Street Journal's unicorn list.

How many do you have now?

David:

Well, today I've got 70 in my portfolio

Daymond:

And that's deal flow.

They're called unicorns because they're rare… not like rabbits – because rabbits constantly appear and multiply fast.

Alright David, I'll see you later.

David:

Looking forward to it, Daymond.

Daymond:

David is very bullish on the future.

So is our next entrepreneur…

Buck Jordan – glad to see you here.

Buck:

Great to see you, Daymond.

Daymond:

Your firm has invested in 450 startups – including Bouqs. My fellow sharks all passed when they first saw this pitched.

And now they're worth nine figures.

I ASKED YOU TO JOIN OUR MISSION BECAUSE YOU'RE ONE OF THE LEADING EXPERTS ON WHAT I CALL "THE RISE OF THE MACHINES."

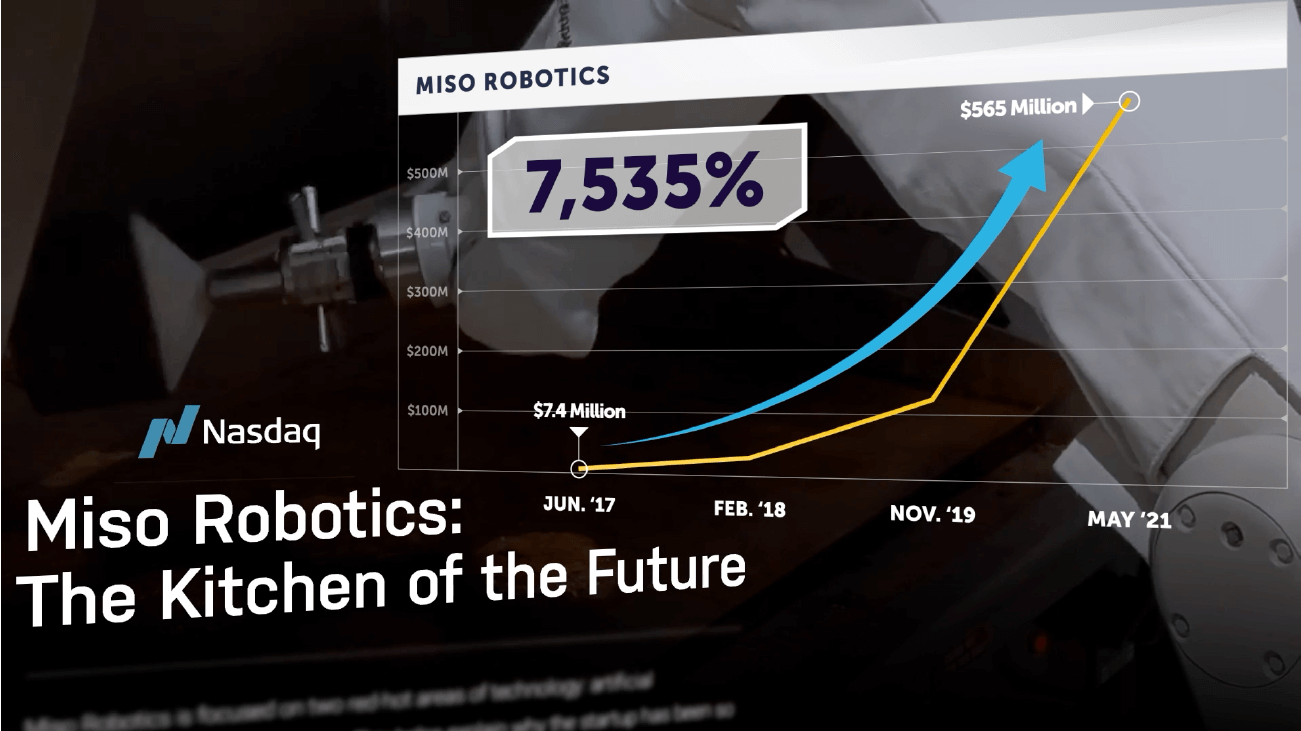

You co-foundedMiso Robotics.

You're building robots that can cook burgers for restaurants.

You're also the chairman ofGraze Mowing…

A startup building solar powered, robotic lawn mowers.

Many see automation as a threat to our jobs.

But the rise of the machines doesn't scare you, does it?

Buck:

Not one bit.

Just look behind me.

Daymond:

Sure.

But have you seen those robots doing gymnastics?

Buck:

I sure have.

Daymond:

Alright, well have you seen that creepy robot dog walking up stairs and opening doors while a guy hits it with a stick?

Buck:

Seen it.

My CTO was actually the director of robotics atBoston Dynamics.

Those robots don't exist without him.

It's human nature to be scared of new technologies.

Tell me something though…

In the 1830s, it took a farmer almost two weeks to produce 100 bushels of wheat.

By 1975… three hours.

You think that farmer in 1975 was scared of tractor technology?

Daymond:

Good point.

Buck:

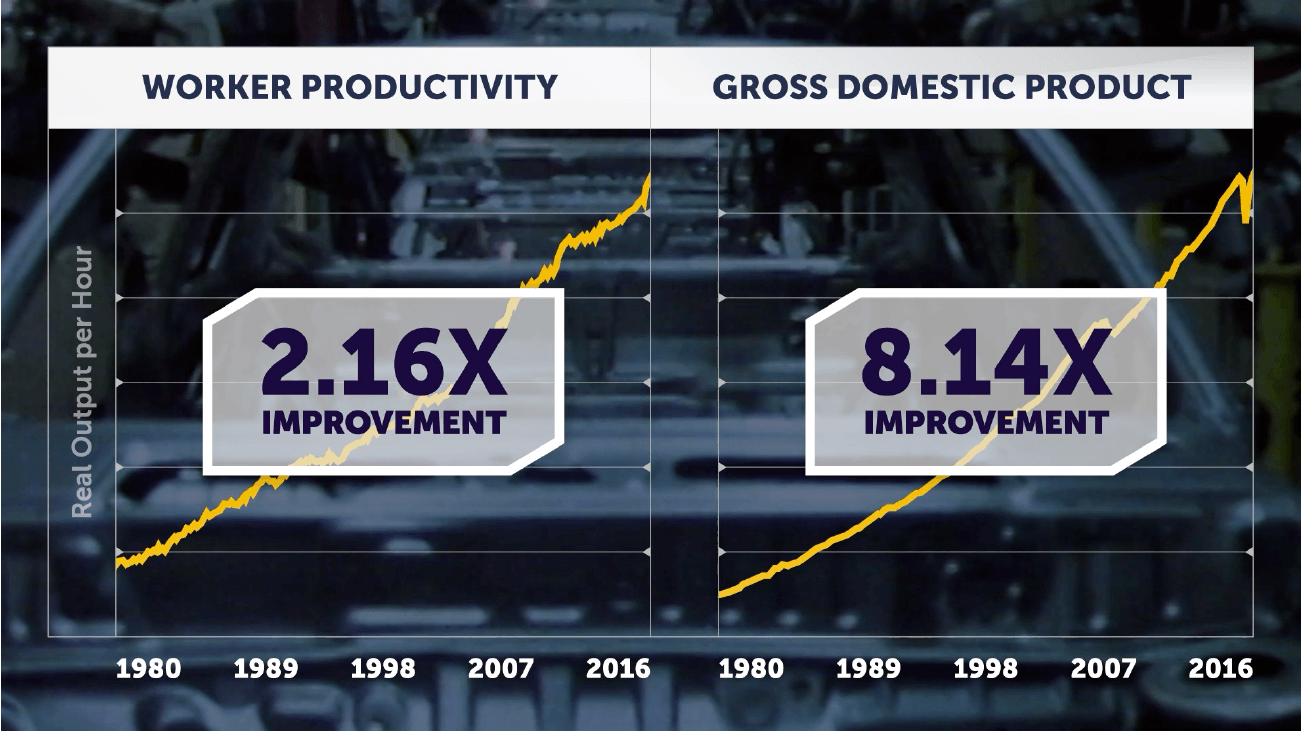

The rise of the machines really got moving in the 1980s – with those robots on the assembly lines.

We saw worker productivity increase…

And an incredible economic growth.

Still, anybody who tells you automation won't threaten certain jobs is lying.

This robot barista fromCafe X makes coffee two or three times faster than a human.

Never takes breaks, vacations, or sick days.

The U.S. has over 505,000 baristas.

Automation is a risk to those kinds of jobs.

Daymond:

AS ANGEL INVESTORS, WE DON'T FEAR THE FUTURE.

WE INVEST IN IT.

How should we play the rise of the machines?

Buck:

MANUFACTURING JOBS ARE THE FOUNDATION OF AMERICA'S COMEBACK.

WE'RE BATTLING CHINA.

WE SHOULD FOCUS ON STARTUPS DEVELOPING TECHNOLOGY THAT'LL BOOST OUR MANUFACTURING PRODUCTIVITY WITHOUT THREATENING OUR JOBS.

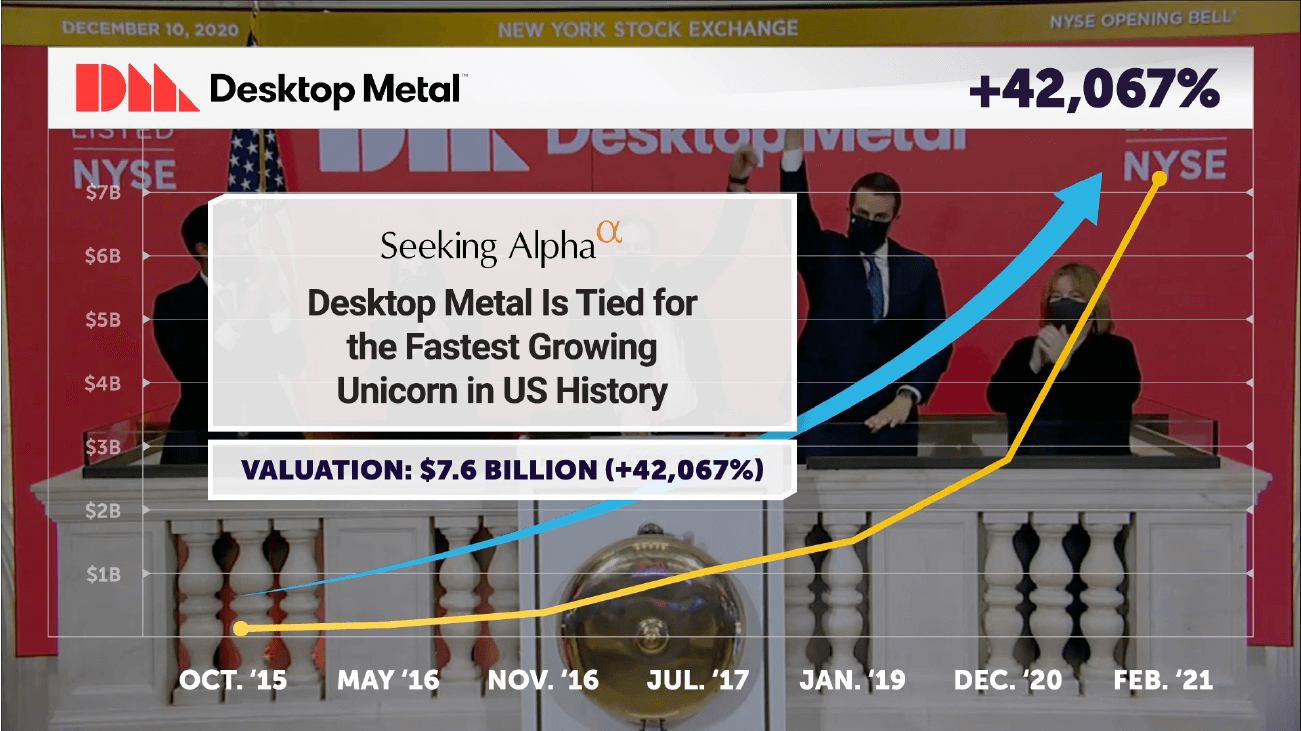

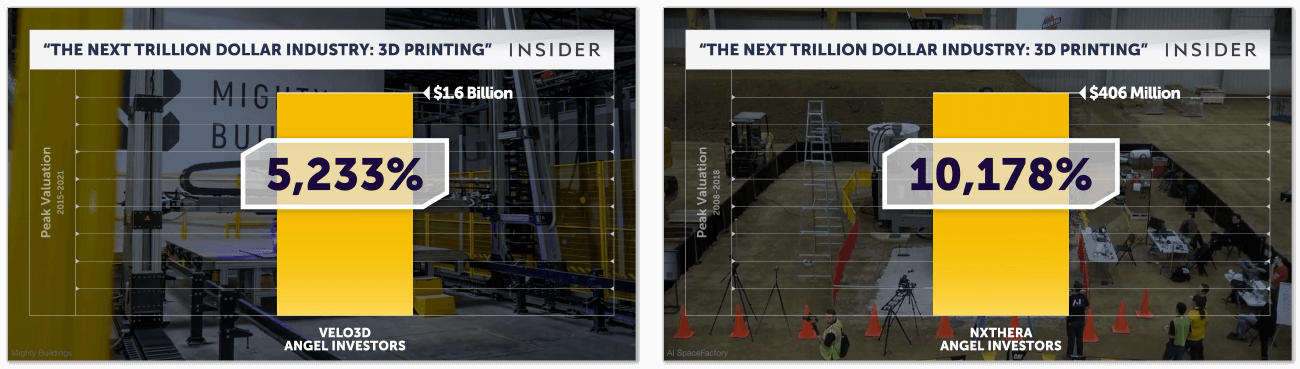

3D printing looks to become a $41 billion industry.

Desktop Metal was the early winner in that race.

It took less than two years to become a unicorn.

And they won't be the last.

Industrial 3D printers are becoming common in factories.

They're helping American workers build the homes we live in – the cars we drive…

And the planes we fly.

Daymond:

In addition to 3D printing, we've seen a good number of startups – likeSlackand Zoom – become unicorns helping employees optimize productivity…

And also how they manage projects when they're separated by distance.

Buck:

Big data made that possible.

That industry is projected to reach over $229 billion.

Snowflakeis one of the kings of big data.

Daymond:

When they IPO'ed, all the news could talk about was that Warren Buffett was jumping in.

Buck:

But who really wonSnowflake's IPO?

Sure looks like those angel investors beat Buffett.

Daymond:

Because they were there at the beginning.

Buck:

I'd also say, with the rise of the machines impacting some folks' jobs – startups will offer new ways to find new jobs.

For instance, Clubhouse has risen so fast it's already a buzzword.

Now, everybody is using it to hire new talent or get hired themselves.

January of 2022 is when the first angels got in – before the COVID lockdowns.

No users – barely a prototype.

Fast-forward to May – lockdowns everywhere.

Clubhouse has 5,000 users in a beta test.

VC firm, Andreessen Horowitz said, "We think you're worth $100 million."

Smart move.

January of 2022 – Clubhouse was valued at $1 billion.

April of 2021… $4 billion.

Daymond:

Now they joined the list of unicorns.

Buck, stick around.

Buck:

I'll be here.

Daymond:

The rise of the machines is reality.

Fortunately, startups are emerging that will retrain workers for new careers – and teach them new technologies.

This is called education technology – or EdTech.

Neil Patel is here to talk about this.

What's up, Neil!

Neil:

Hi, Daymond.

Daymond:

I call you "Mr. Top 100."

Entrepreneur Magazine's top 100 most brilliant companies in the world – you founded one of them.

The White House's top 100 entrepreneurs under the age of 30 – you made that list.

The United Nations' top 100 entrepreneurs under the age of 35 – that one too.

And you're also a New York Times best-selling author.

NEIL, WHY ARE EDTECH STARTUPS CRITICAL TO AMERICA'S COMEBACK?

Neil:

America is competing with the rest of the world for who can best educate their kids…

And our companies are competing with every other country's – to out-innovate how we train our workers.

The numbers tell the story.

The EdTech industry is set to jump 148% – from pre-COVID levels – to $404 billion.

Daymond:

The initial winners were startups likeUdemy.

General Mills,Adidas, andKaiser Permanente rely on them to train their remote workers with new skills.

Courserawas another winner.

They partnered with Yale, the University of Michigan, 200 universities and institutions – along withIBM,Google, and other major employers – to train their workers.

Neil:

Expect more startups to enter this market to address the growing demand.

Daymond:

I love the do-it-yourselfers – I'm one of them.

Neil:

Me too.

Daymond:

During the pandemic, folks took it upon themselves to learn all types of new skills.

Neil:

Startups made it really easy for someone to take control of their own education – to empower themselves.

Everybody has heard ofMasterclass.

They enlisted all these celebrities to teach their secrets.

Cooking, filmmaking, negotiating business deals – even playing tennis like Serena Williams.

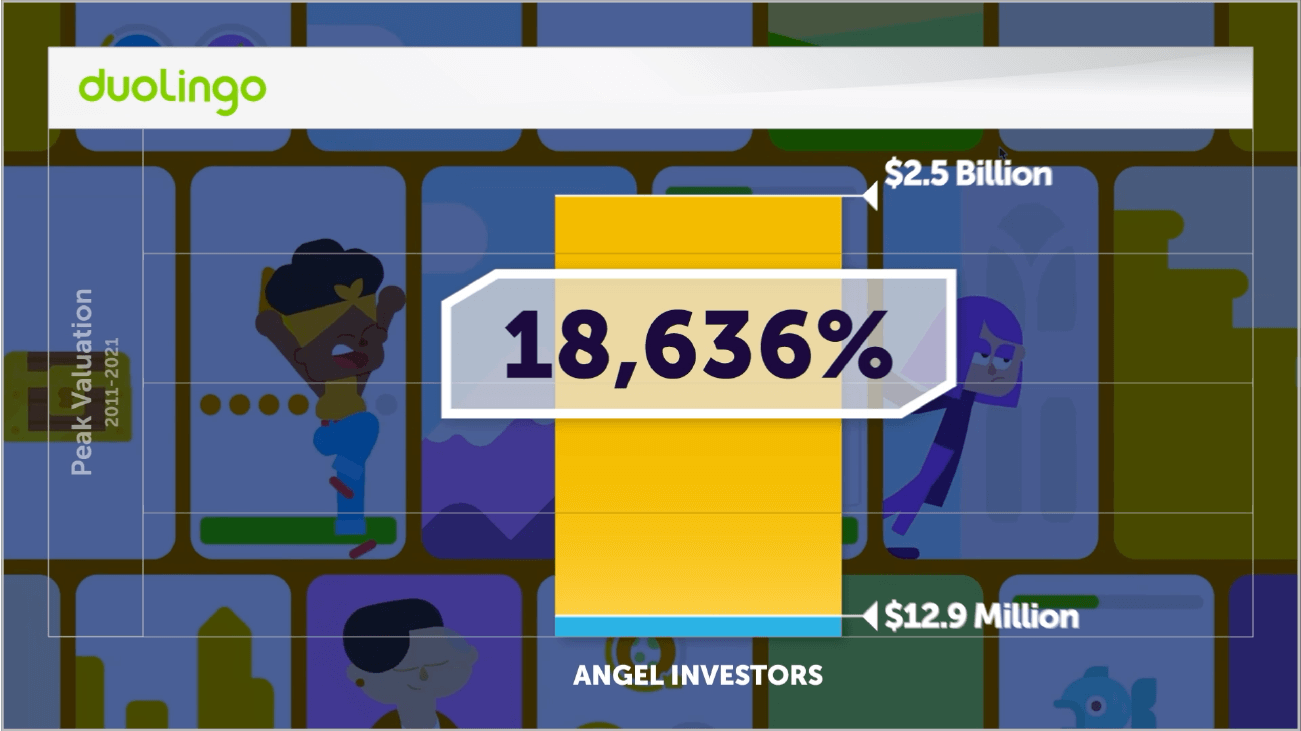

Look, even learning a new language has become a very competitive space.

Duolingo uses games and rewards systems to make that easier.

Maybe the next unicorn isFluent Forever.

They developed a method for teaching anybody a new language in six months…

Even mandarin.

Daymond:

Neil, tapping into your deal flow is a big part of our mission.

Thank you so much for talking with us.

Neil:

I'm ready to help.

Daymond:

Neil and I have joined forces with other rock-star angels like David and Buck…

And Zach Ginsburg, who backed famous unicorns likeCoinbaseand Airbnb.

Altogether, over 100 of the top business minds.

WE HAVE THE DEAL FLOW TO ACCOMPLISH OUR MISSION…

AND OUR MISSION HAS THREE PARTS.

Part 1: We'll use our deal flow to land startups that pass our 1,000X Formula.

Part 2: We'll only select those who'll immediately use investment capital to create new American jobs.

Part 3: We'll empower angels like you to work together with those startups to help them win.

With some luck, they could become unicorns even faster than we've seen before…

And we're recruiting you for our mission.

Say "yes," and you'll join our Angels & Entrepreneurs Network .

Let's get Buck back on the monitor.

Buck, welcome back.

So are you ready to launch our mission?

Buck:

I'm ready.

Daymond:

Laura, explain how we're going to pull this off.

Laura:

EVERY MONTH, OUR TEAM OF EXPERT ANGELS WILL EXAMINE HUNDREDS OF STARTUPS.

As you know, many are partners at high-profile VC firms themselves.

They have the best of the best deals at their fingertips.

They'll quickly eliminate 99% of them.

They won't pass our 1,000X Formula.

Next, we're going to select our top two deals.

Our team of analysts will independently examine these startups to make sure our expert angels didn't miss a thing.

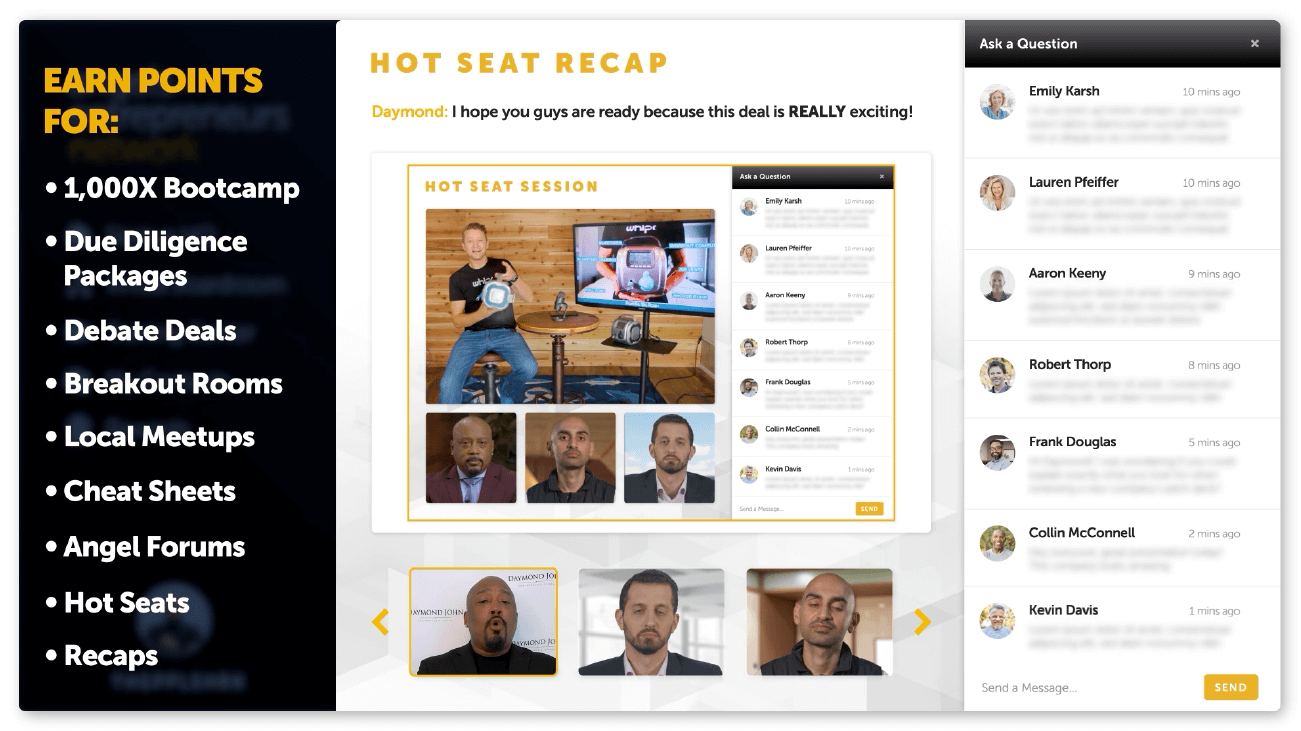

AND WE'LL BRING IN THE FOUNDERS TO CONDUCT HOT SEAT SESSIONS.

THESE ARE LIVE AND INTERACTIVE BUSINESS PITCHES.

Daymond:

The energy is gonna be off the charts.

If you've seen me on TV sitting in that chair, grilling entrepreneurs – it's gonna be just like that – except we're all getting chairs.

We're working together. Everybody is going through each deal – firing off questions left and right for these founders to answer.

WE'LL MAKE THEM EARN YOUR MONEY, MY MONEY – EVERYBODY'S MONEY.

Buck, you're both an angel and an entrepreneur. Why is this a big deal?

Buck:

Normally, the founders of the hottest startups hold all the cards.

They'll only pitch to major venture capital firms.

We're turning the tables on them.

Now, they're pitching to everyone in our network.

Daymond:

Because we have the deal flow.

Buck:

Well, not just that.

We offer something those VC firms can't…

Something that could help a startup become a unicorn – even more than a big pile of money.

Daymond:

We have an ace up our sleeve.

Before we reveal it, we've got a few things to discuss.

You might be new to angel investing – or a pro.

Doesn't matter.

You'll be prepared for every Hot Seat Session.

Josh, how are we gonna do that?

Josh:

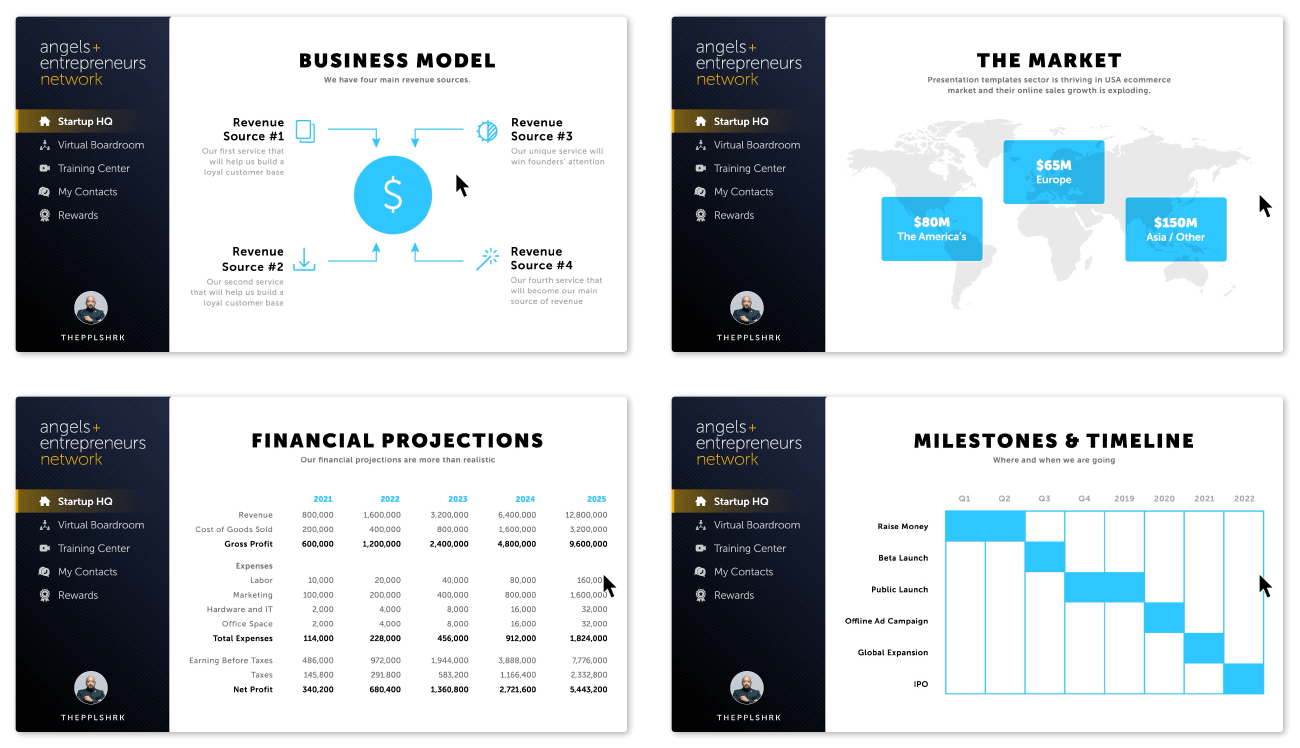

A WEEK BEFORE THOSE FOUNDERS PITCH, WE'LL ADD THEIR COMPANY TO OUR 24/7 STARTUP TRACKER.

It'll import every news article, press release, and announcement that mentions that startup…

And constantly update with new developments.

WE'LL ALSO SHARE THAT STARTUP'S DUE DILIGENCE PACKAGE.

Daymond:

Buck, when I get a Due Diligence Package, I'm like a kid on Christmas morning.

You're the founder – I'm the angel investor – why am I excited?

Buck:

Because I just shared my startup's most sensitive information with you.

Daymond:

You got it.

And what's in a Due Diligence Package?

Buck:

You'll see theirPitch Deck – that's their official investor presentation.

Every startup had them in their early days – fromUber andPeleton…

ToAirbnbandFacebook.

But founders tell you the story they want you to know in their Pitch Deck.

To see if that matches reality, you gotta act like a detective and really comb through that Due Diligence Package.

Daymond:

That's right. Dig through their business plan and their strategy – their projections and their timelines…

Buck:

Yep. Any proprietary technology they're developing…

Their patents… every deal or partnership they have in the works.

Daymond:

Their Term Sheet.

Buck:

Pretty important piece of information.

Daymond:

In other words, what deal are they offering us?

Now, once we send that Due Diligence Package…

We don't just say, "Have at it," and call it a day.

The pros are on the job – right,Sohail?

Sohail:

Of course.

OUR TEAM OF EXPERT ANGELS WILL CONDUCT A DEEP DIVE VIDEO REVIEW…

Taking The Network through every document, chart, contract, and projection that startup shared with us in their Due Diligence Package.

WE ALSO RELEASE OUR ANGEL INVESTOR ACTION PLAN WITH OUR ANALYSTS' INDEPENDENT RESEARCH AND A STREAMLINED SUMMARY OF THE DEAL.

Plus, a thoroughSWOT analysis.

This way, members can see the deal through our eyes.

Buck:

Mind if I jump in?

Daymond:

Go for it.

Buck:

SWOT is industry jargon…

Stands for strengths, weaknesses, opportunities, and threats.

What do we like and dislike about this startup? What are the risks?

Is there something hiding under the surface that could cause this startup to fail?

Or maybe some secret competitive advantage nobody has picked up on yet?

Daymond:

This is like being invited over to some famous Silicon Valley venture capital firm…

And having them dissect every deal point by point on your behalf.

But we don't need those guys – do we, Buck?

We have the rock-star angels and entrepreneurs – like you – on our team.

Buck:

And we have the deal flow.

Daymond:

Laura, we've given The Network all of this information.

The countdown has begun.

Only seven days until we put those founders on the Hot Seat.

What's next?

Laura:

Our experts got the ball rolling.

NOW, WE'RE INCLUDING THE ENTIRE NETWORK TO FURTHER EXAMINE THAT STARTUP.

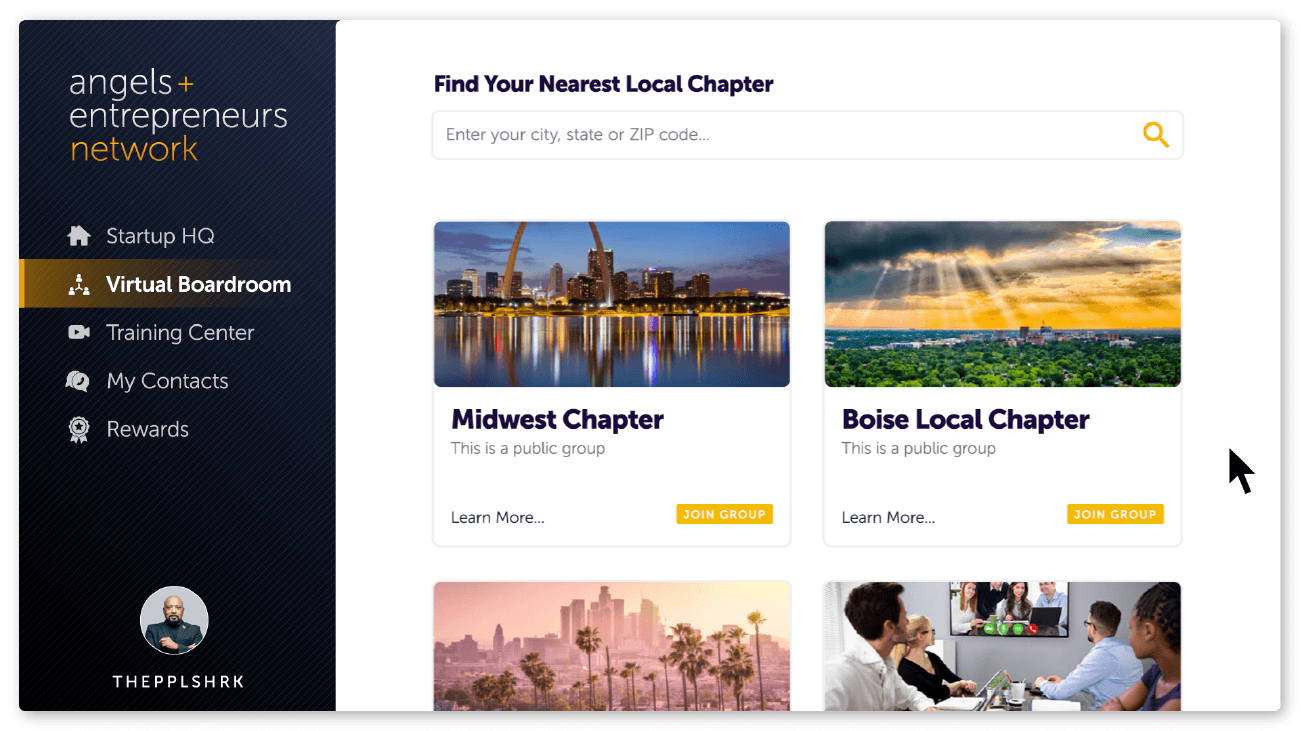

WE'LL CONDUCT A SERIES OF DEBATES IN OUR VIRTUAL BOARDROOM – TO DECIDE IF ITS FUTURE COULD INCLUDE A MULTIBILLION-DOLLAR VALUATION.

Then, if some members really want to delve into a particular deal, they can form their own Breakout Rooms and invite, say, 2, 5, maybe 10 people into more focused conversations.

We're providing them with free video conferencing software.

They can even launch their own local chapter in their city or town.

Daymond:

THIS IS ALL ABOUT TEAMWORK.

AND WE WANT EVERY SUBSCRIBER'S VOICE TO BE HEARD.

Buck:

In this network, we can all be mentors – and be mentored.

If someone is a brain surgeon, they might learn a lot about an electric vehicle startup from somebody who's a mechanic…

And that mechanic might learn a lot about a robotic surgery startup from that brain surgeon.

Daymond:

That's the beauty of the Network Effect – a bunch of people collectively working together toward a common goal…

And we're gonna get that Network Effect moving fast.

WE'VE CREATED A REWARDS SYSTEM – WHERE YOU'LL CONSTANTLY EARN POINTS FOR COLLABORATING WITH EVERYONE, HITTING MILESTONES, AND HELPING THE STARTUPS.

You can trade in these points for…

Sohail, what – office supplies, electronics?

Sohail:

Access to special events, gift cards – even cash.

Daymond:

Tell us some ways to earn points.

Sohail:

WHEN MEMBERS FIRST JOIN, WE RECOMMEND THEY WATCH OUR 1,000X BOOTCAMP FOR ANGEL INVESTORS.

It covers all of the 101 stuff – plus, our experts will dive into their secrets.

Other ways to earn points…

Review a Due Diligence Package… attend a debate in our Virtual Boardroom…

Create a Breakout Room or start a local chapter – even more points.

Daymond:

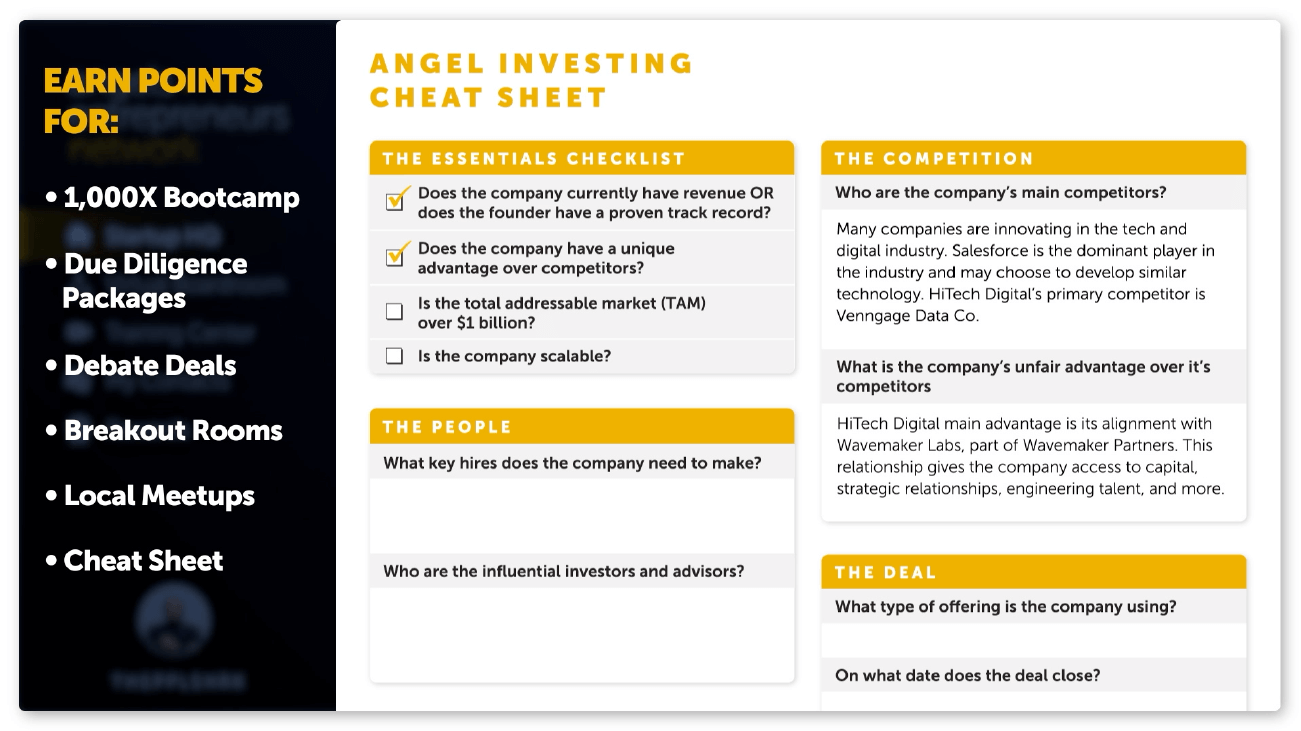

During all these debates and discussions, if somebody makes a good point, type that into ourAngel Investor's Cheat Sheet.

Our system will save everything.

For the Hot Seats, our experts have prepared a basic set of questions every founder should answer.

You can add your own questions as well.

Just fill in the founder's answers on theCheat Sheet to study later.

Sohail:

Each time a member completes aCheat Sheet for a startup…

Points on the board.

WE'VE ALSO CREATED ANGEL FORUMS – WHERE MEMBERS CAN SHARE DEALS THEY'VE FOUND ON THEIR OWN…

And other members will vote on them.

The winners will earn points.

Daymond:

Definitely big points for attending aHot Seat Sessions.

Sohail:

A lot of points.

Same goes for reviewing ourHot Seat Recap…

Our final assessment of that startup, the deal, and founder's live pitch.

And we'll reveal which experts are gonna have skin in the game.

Daymond:

That's important.

I'M PUTTING UP $100,000 TO INVEST IN THESE STARTUPS – WHATEVER I MAKE OFF THESE DEALS IS GOING TO CHARITY.

OUR EXPERTS – LIKE BUCK, DAVID, AND NEIL – ARE PUTTING THEIR MONEY IN AS WELL, IF THEY WANT.

So you'll know who is in and out.

Buck, talk about that ace up our sleeve.

Buck:

Our secret weapon.

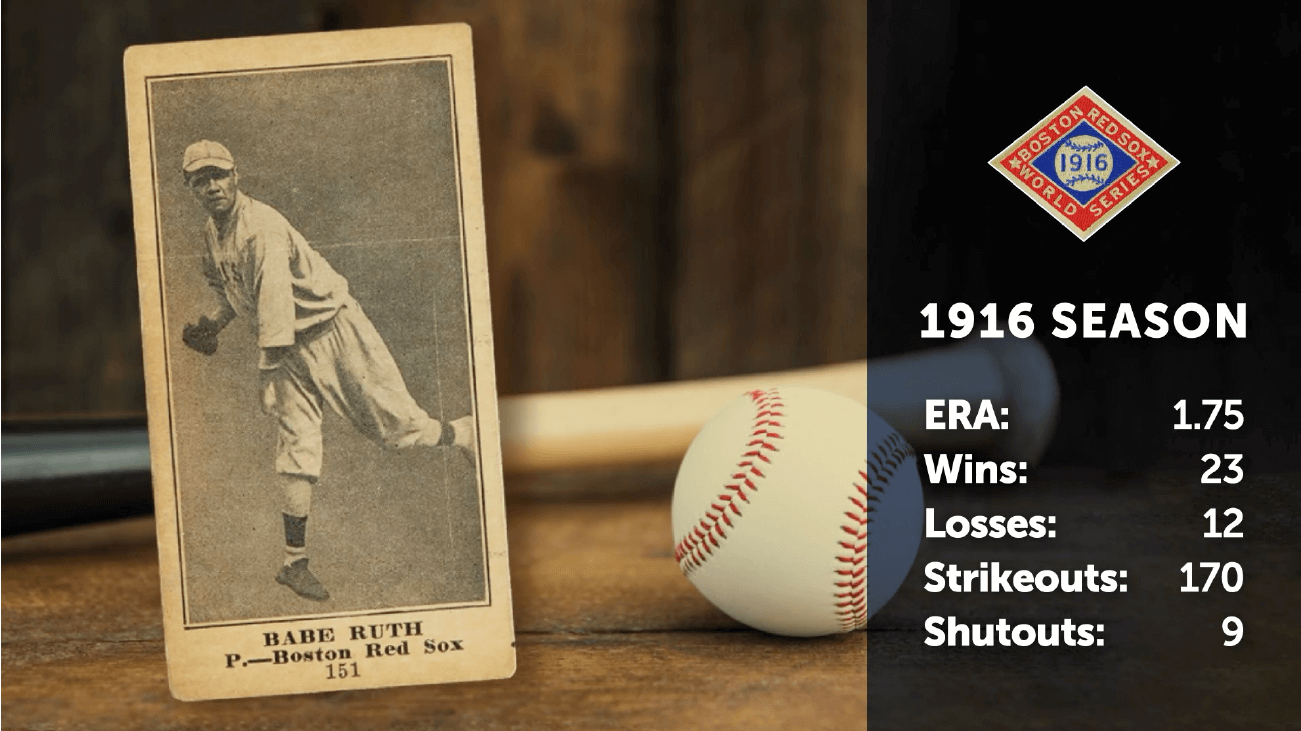

Easy way of thinking about it – Babe Ruth was one of baseball's greatest hitters.

One of the best pitchers too.

In 1916, Ruth had a league-leading ERA of 1.75 and tossed nine shutouts.

Daymond, what would've happened if Ruth went up against any pro team all by himself?

Daymond:

He'd get his clock cleaned – can't cover the entire field.

Buck:

Now, who is better positioned to help a startup?

One venture capital firm…

Or an army of Main Street angel investors – each with their own areas of expertise and knowledge – and each driven to see that startup succeed?

Daymond – me, you, everybody on our team joined this mission because we know the answer.

Daymond:

An army of Main Street angel investors.

Buck:

Exactly.

AND WHAT SEPARATES US FROM VC'S IS WE CAN GIVE THOSE ROCK-STAR FOUNDERS THE KIND OF HELP THEY WON'T RECEIVE ANYWHERE ELSE.

WE'LL HARNESS THE NETWORK EFFECT AGAIN.

Daymond:

We're making this extremely easy.

IT'S CALLED OUR 60-SECOND LIGHTNING REVIEW.

Before they pitch, we ask the founders to give us a set of important questions about what they'd like to get your take on.

What challenges do you see them facing? Where are the biggest opportunities?

You can score their pitch.

Tell the founders what you did and didn't like about it.

Do you plan to invest? If so, why? If not, why?

This is priceless market intelligence.

After the founders finish theirHot Seat, we'll give you a quick form to fill out with those questions.

If you choose to answer them, it's the single biggest way to earn points.

.

ANGELS CAN ALSO HELP FOUNDERS THROUGH THEIR INVESTOR UPDATES.

Buck:

It's a major way to help them.

Investor Updates are like progress reports.

Founders share where they stand with revenue… new deals they've inked… challenges they're facing

But here's a big secret folks should know about.

Founders always ask their angels for advice or help in those updates.

They might be looking for strong job candidates. Maybe you can introduce them to a potential client or a vendor that could save them some money.

Help them, and they might give you free shares in their startup.

Daymond:

I call these the "Hey, I know a guy" moments.

IF THE FOUNDERS ASK FOR HELP – AND "HEY, YOU KNOW A GUY" THAT CAN HELP OR YOU CAN YOURSELF, THEY MIGHT JUST GIVE YOU FREE SHARES, EVEN IF YOU DIDN'T INVEST.

Normally, founders won't sendInvestor Updates to smaller angels.

By that, I mean people who invest less than $50,000 in a deal.

That's not happening with us.

It doesn't matter if you invest $50 or $50,000 – or you don't invest at all.

You'll receive Investor Updates for every startup we showcase.

Buck, we've done enough talking. It's time to act.

Laura, how can people join our mission?

Laura:

We spent months developing our plan and recruiting the right team.

Given the resources behind this, we initially proposed a subscription price of $599.

You told us…

Daymond:

Cut the rate – I remember.

Laura:

Yes, make this available to as many Americans as possible.

Daymond:

But keep every part of our plan intact. Build it all.

I know it's a tall order – but you guys came through.

Laura:

We brought the subscription rate down to the bare minimum.

Every penny going to running this mission.

Daymond:

Including the charity component, right?

Laura:

It's there.

For every new member, we're donating $5 to the Network for Teaching Entrepreneurship.

Daymond:

Look, I gotta tell ya… I'm on the board. We empower future leaders in financially struggling communities to start their own businesses – so they can create more jobs.

Laura:

We're sending you to deliver the donations with those big, oversized checks.

Daymond:

I would be absolutely honored.

Again, I'm investing $100,000 into these startups.

Everything I make will be donated.

Laura:

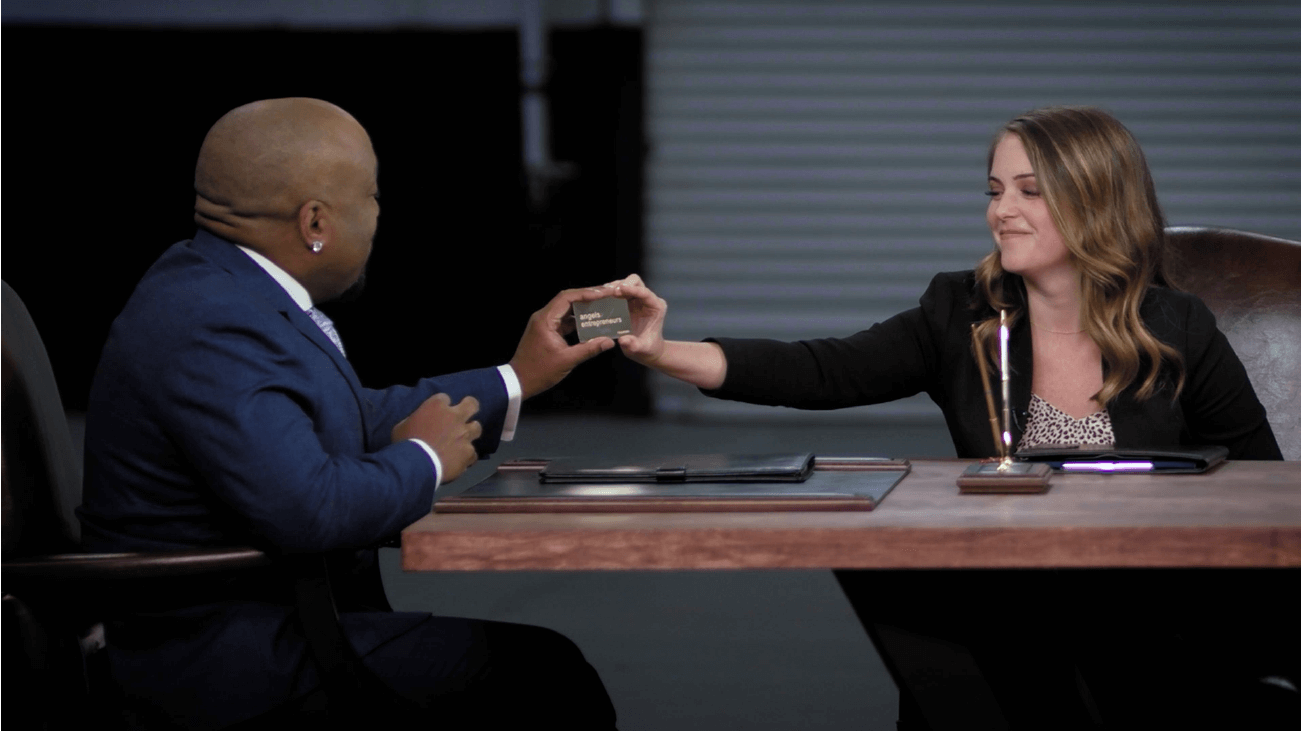

WE HAVE TWO STARTUPS ALREADY LINED UP THAT PASSED OUR 1,000X FORMULA.

NEW MEMBERS WILL GET ALL THE INFORMATION ON THEM.

And their welcome package will include thisgold membership card.

This one's yours.

Daymond:

I've been waiting for this.

And this makes it official.

Laura:

Buck, yours is in the mail.

Everyone can bring their cards to our annual retreat.

Daymond:

I'm gonna take this one though.

Every year, we'll hold the retreat somewhere sunny.

San Diego, Charleston, Grand Cayman Islands.

And you can bring a guest too.

THIS IS A CHANCE TO GET TOGETHER AND GET TO KNOW EACH OTHER.

YOU'LL MEET OUR EXPERT ANGELS. WE'LL BEING IN FOUNDERS TO PITCH THEIR STARTUPS.

Buck, any final words?

Buck:

Just a few.

Despite what many think, 88% of millionaires are self-made.

Angel investing is a path that can lead to that outcome, but that's not why I love it.

It's a way to make your childhood dreams come true.

If you wanted to be an astronaut as a kid, you could've been an angel investor inSpaceX.

Obviously, you took the risk – so you deserve the biggest rewards.

But you also became a part ofSpaceX's story – you mattered to that startup.

Maybe you aren't traveling to the moon or Mars…

But you played a direct role in others doing it.

Daymond:

Buck, thank you so much for joining our mission.

Buck:

Let's get moving.

Daymond:

I wasn't born with a silver spoon in my mouth.

I'm dyslexic. Dad left when I was young.

Didn't go to college, and I didn't let that stop me.

But I couldn't have succeeded without my first angel investor.

WE'VE REACHED ONE OF THOSE MOMENTS IN TIME WHEN ANYBODY CAN TAKE CONTROL OF THEIR DESTINY – NO MATTER WHAT HAPPENED IN THE PAST.

ANGEL INVESTING CAN BE THAT NEW ADVENTURE THAT OPENS NEW DOORS FOR YOU.

WE'RE GOING TO HELP YOU – OUR DEAL FLOW IS SOMETHING EVERY ANGEL WANTS.

We're sharing it with you.

And if you take that first step today,you can play an important role in America's Comeback.

Click the button below, fill out the short form, and you're in.

To kick things off, you'll receive the details on the first two startups to pass our 1,000X Formula.

For my entire team, I want to thank you for joining us.

If you have any questions about the service and how it will work for you, I encourage you to contact our reliable customer service team at 866-310-1498 or 443-221-6766 (for international calls) and mention Priority Code:LAGNY201.

Let's get to work.

Copyright – 2022 Angels & Entrepreneurs, LLC. Legal Notices: In order to ensure that you are utilizing the provided information and products appropriately, please be sure to visit Angels & Entrepreneurs disclaimer and privacy policy pages.

Source: https://www.stocktrendalerts.com/daymond-john-americas-comeback-summit/

0 Response to "Where Do They Sell Make America Great Again Hats"

Post a Comment